Discover how income protection insurance can provide financial security if illness or injury prevents you from working. Learn what it is, how it differs from ACC, who needs it, and why it could be the essential safety net you didn’t know you needed.

-

Is income protection right for you?

-

Can you afford not to have life insurance

Discover why life insurance is crucial in New Zealand’s challenging economic climate. With rising costs, inflation, and increased financial pressure, securing your family's future is more important than ever. Can you afford not to have life insurance?

-

Why you should buy your life insurance online

A recent survey by Consumer NZ indicated that you’re much less likely to be a satisfied customer if you buy insurance from a bank or an insurance broker, compared with those who buy direct from an insurance company.

-

Will life insurance pay for cancer? (the answer is yes)

Life Insurance can’t stop you from getting cancer but it can help you financially while you get treatment. If you’ve had cancer, bear in mind that each case is considered by our underwriters, so don’t assume you won’t be able to get any cover.

-

Is life insurance worth it? 5 reasons why we think it is

Having life insurance is a good idea if you have financial obligations that mean your loved ones would suffer if you weren’t around to pay for things like the rent or mortgage, the groceries, or your kids’ education. But is it worth it?

-

How age affects your life insurance (explained)

One of the biggest factors in determining the price of your life insurance premium is your age.

-

Sleep best life insurance policy you can have (says world sleep expert)

If you want to live longer and live well, prioritise your sleep. It’s the cheapest life insurance there is.

-

Top tips to getting your life insurance money quickly

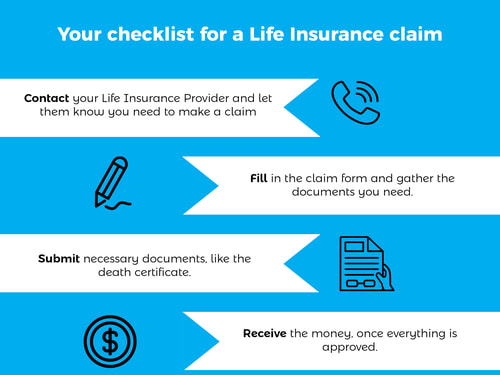

We’ve paid 98.9%* of the claims made on our policies. That’s because everything we do, from the moment you first take out a policy, is about making sure we can pay your claim when the time comes.