The idea behind life insurance is simple, you pay premiums to a company and when you die they pay some money to your loved ones, so why does that need a multi-page document to explain?

Your policy document sets out the agreement between you and your insurer. It turns out that takes quite a lot of explaining. At Pinnacle Life our policy document is 5 pages long. There’s a fair amount of white space and the font size is nice and readable but there’s still an awful lot to read and understand. Our document includes:

- How to contact us – phone numbers, physical address and emails

- Specific and important information about your cover. Things like, whose life is insured, who will be paid the money, how much will be paid if the insured person dies or gets terminally ill, and how much premiums are

- Information about who can buy this kind of policy and the maximum amounts that can be covered

- Information about what changes can be made and how to go about them - for example increasing or decreasing your cover, changing the policy owner, or that you’ve stopped smoking

- How to cancel your policy

- Information about your premiums – how premiums are calculated, when premiums are due, how you can pay, what happens if you miss a payment

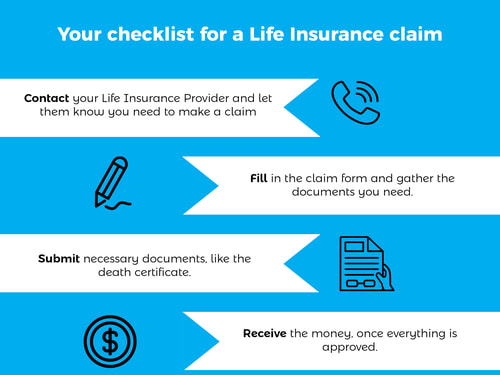

- Information about how to claim and what you need to provide before we can process your claim

- And finally, compliance information for NZ law, in particular about privacy and confidentiality, and a list of definitions.

Most providers include a sample policy document on their website so you can have a look before you buy your insurance. If you don’t understand what you’re reading, it may not be the best provider for you. This also means you can compare providers, but that can get tricky if they use different terminology to describe the same thing. It is however important that you at least read your policy document when you first get your cover to make sure you’re paying what you thought, that the right person is insured and that the right person owns the policy.

At Pinnacle Life we like to keep things as simple as possible. We hate it when things get too complicated. That’s because we’re simple people ourselves! While we have lawyers and actuaries that advise us, (to make sure we don’t do anything that might lead to trouble later), we are regular kiwis with families to protect. We want to understand what we’re buying, just like our customers.

We’ve been committed to keeping things clear and straightforward for a really long time. Nine years ago we won an award for our plain English policies and website, and we haven’t changed our approach since then. We haven’t entered any more awards since then either but maybe it’s time we should?

The Plain English Awards are a public pat on the back for plain English champions and help to raise the bar for clear communication.