We happily choose electricity providers, mobile phone companies and even car insurance providers for ourselves, so why does choosing a life insurance provider feel so much harder? If it's the first time you've decided that you need cover, and you've figured out how much you need, the next question is how to choose your provider. And it isn't as complicated as most people may think, or as tricky as brokers would want you to believe.

Some websites advise you to never go direct to an insurer first. They say you'll pay full price and have nothing to compare it with. We disagree. We think you should absolutely do your own homework. Approach insurers directly and understand what they offer. Then make your own comparisons. If you have a special health need or family situation, then talk to an expert. For most people, however, there's no reason why you can't choose for yourself.

- Start by making a list of providers. Do you have cover somewhere already? Ask your friends and family who they have cover with, look out for ads on TV, radio, and YouTube, and do a google search. You can also check comparison sites such as Glimp or MoneyHub. Once you've got a list with a few providers, you can start to make some comparisons.

- Look for customer reviews. These days finding out what other people think is easy. Check reviews on Google and Facebook and look for the providers' response. You can also check independent review websites such as Feefo and TrustSpot. Most providers websites will also include a page for customer feedback and reviews. If there aren't any 'constructive' reviews, be suspicious!

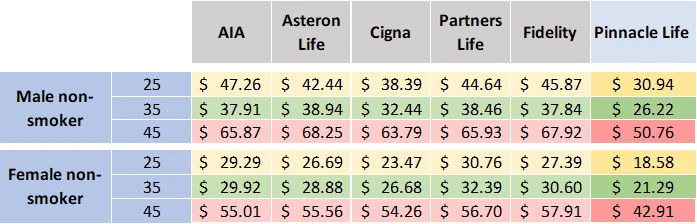

- Get some quotes. We recently surveyed our customers and asked them what they considered when choosing a life insurance provider. 73% of respondents answered that Pinnacle Life had the best price for the benefits included. Most providers will offer some discounts, either for healthy living, the first-year or multiple policies. Make sure when you're comparing on the price that you've factored in the discounts available.

- Consider what extra coverage you may want. A Life Insurance policy will pay out a lump sum if you die or are diagnosed with a terminal illness and have 12 months or less to live. You can 'add-on' Critical Illness or Disability cover to your life insurance policy so that you have cover if you don't die but are diagnosed with critical conditions or become permanently disabled. This cover will cost extra and the conditions that are covered may vary between providers so think about what's most likely to happen to you—for example, a cancer diagnosis, stroke or heart attack.

- Financial Strength and Claims payments. Of course, you want to make sure that your life insurer will still be around when you need them, and that they will be able to pay yourclaim. There are a few different rating agencies used by NZ insurers, including A.M. Best, Standard & Poors and Fitch ratings. Each will evaluate companies slightly differently, but ratings generally are based on factors such as financial holdings and how much is being collected in premiums. All the best companies in NZ are financially strong. A.M Best rated Pinnacle Life Limited 'B' financial strength (outlook 'stable') and a bb+ issuer credit rating (outlook 'stable') at 28 February 2020. Hannover Life Re of Australasia backs us. They are rated as AA- "Very Strong" by Standard & Poor's and A.M. Best as A "Excellent". You should also look at what percentage of claims have been paid. Most companies will publish this figure. As of 14 August 2020, Pinnacle Life had paid out 99% of all claims on our policies.

There's no reason you can't choose for yourself. Start today!