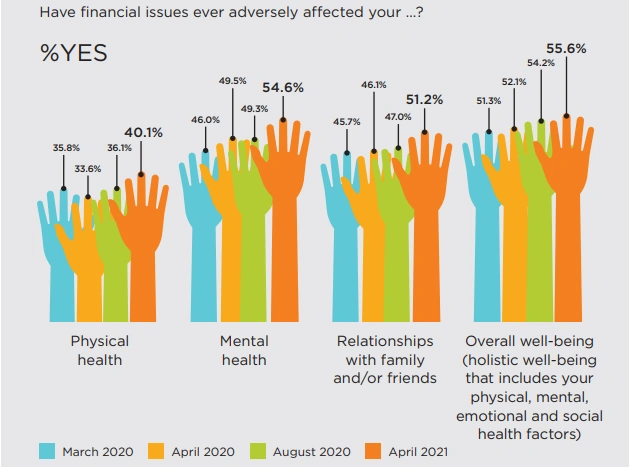

Worrying about money can be bad for our mental health, and poor mental health can be bad for managing money. It's a nasty trap to fall into and a tricky one to get out of. Research recently published by the Financial Services Council indicates an increase in how financial issues are affecting our wellbeing. Worryingly, the trend indicates that financial issues affect more than our mental health but also impacts our physical health, relationships, and overall wellbeing.

On the plus side, overall, we are less worried about money than we were pre-Covid. Which is interesting because many of us suffered severe financial hardship in the last year. For those who muddled through, did lockdowns deliver a hard lesson that has a long-term benefit?

- Did we learn that we can't take our income for granted.

- That having a 'rainy day account' is an excellent idea.

- That living beyond our means adds stress.

- That we could live without some of the extra things we thought we needed

- We value things other than money.

If we learnt something, it didn't come easy.

- More people say that financial issues have affected their physical health, mental health, relationships, and wellbeing, from March 2020 to April 2021.

- People under 37 are most likely to be worried.

- Older people are less worried about money than younger people.

The research doesn't give reasons for how wellbeing has been affected or any advice on what to do about it.

When you're under 37, it's the prime time to be starting a family or already have small children -and we all know children are expensive. You also may have just taken on significant debt to buy a house. Unless you've been focused on it, you're unlikely to have built up financial reserves which can give you resilience and options, accessible money for unexpected payments and flexibility in servicing any debt. You also might feel like you're midway through your career and that your options are limited, that you haven't reached your salary potential, or that your business is still growing and needs further investment.

No wonder it's affecting our wellbeing. It's a lot to think about.

The key thing to note if you are feeling affected is that you're not alone. And, that as you get older, hopefully, you too will worry less! If you want help, there are several services available. They are all slightly different, so think about what would work best for you.

- Moneytalks is a free helpline service – that offer advice and support from trained financial mentors. MoneyTalks can also connect you with services in your community.0800 345 123, FreeText: 4029, help@moneytalks.co.nz, Facebook

- Some Citizens Advice Bureau run budgeting clinics

- Enable Me offers financial coaching that will help you get debt free and to meet your financial goals.

Alternatively, online tools can help you work things out for yourself - budgeting and financial goal setting. These tools can help to ease the worry and give you a path forward. They can't help you earn more money! But they can help you feel more in control and help you understand if you really are in trouble or if it just feels like it.

- Sorted- Sorted's budget planner is a simple budgeting tool to manage your money. Sorted can help with budgeting, retirement planning and setting your future goals.

- Booster and mybudgetpal - gives you a complete view of your finances; it tracks your spending so you can compare spending over different periods and isolate areas or habits that need attention.

Hopefully, the days of long lockdowns are behind us but the days of Covid certainly are not. The affects are going to be long term and far reaching. It can be difficult to feel like you have control over how much you earn, but we can all control how much we spend. Feeling in control means we worry less. The more we can do to ease the stress of money the better our wellbeing. Seek help if you need it and look after yourself.