Only some people need life insurance. You probably don't need a life policy if you are single, financially independent, don't have large debts, or if you own a property or business that can be easily sold upon your death.

The intention of life insurance is to make sure your family can stay financially stable even if the worst happens and you are no longer there to pay for it. You can use a life insurance payout in whichever way your loved ones need; to pay off a mortgage, pay the bills, pay for education, or take a holiday. It allows the ones you leave behind to have the life you imagine.

But, there are three circumstances when life insurance is not a good idea.

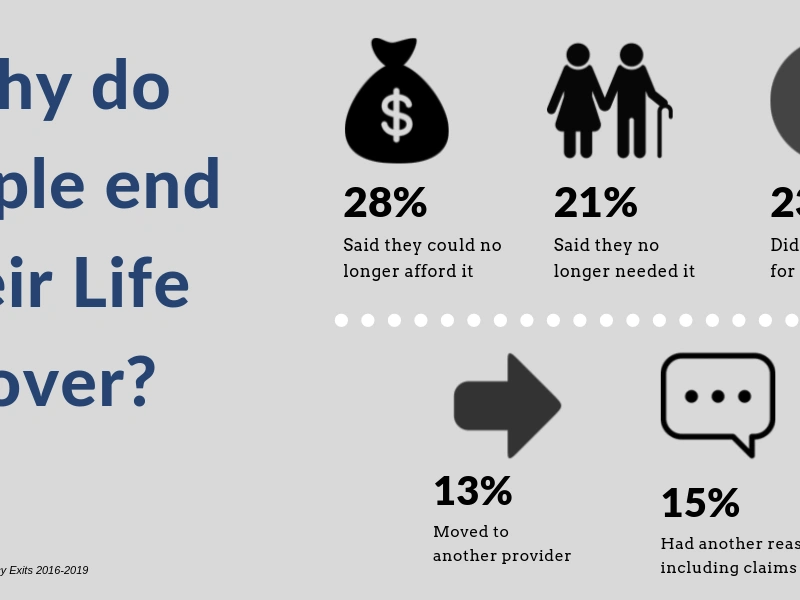

- If you don't need it. The purpose of life insurance is to provide financial support for those you leave behind if you were to get sick or die. So, you probably don't need a life policy if you are single, financially independent, don't have large debts, or own a property or business that can be easily sold if you die.

- If you can't afford it. Life insurance is certainly not more important than putting food on the table, clothing for your children, or paying rent. Always put your current financial needs before insurance. If things change and you're able to think about your future financial security, then insurance should be top of the list. If the worst happens, having life insurance can greatly affect your children's financial future.

- If you're looking for an investment. There is no cash value to a life insurance policy, so you don't get any money back if you cancel your policy. The easiest way to think of it is that it's just like your car or home and contents insurance, it's there if you need it, but it's not accumulating any value. Sometimes we get confused because, in the '80s and '90s, there were policies that had an investment component. You can read more about those here.

There are, of course, excellent reasons when it is a good idea:

- To look after your life partner. Couples who have built a life together should consider life insurance so that if one of them passes away the other can maintain the same quality of life. If you're both financially independent and have no significant debts, then it's not so necessary.

- If you have a mortgage. Homeowners should take out life insurance so that:

- if they can't work due to a serious illness, like cancer or a stroke, they can claim on the critical illness component of their policy and continue to pay the mortgage. Or

- if they die, the proceeds of the policy can go towards paying the mortgage. Paying off the mortgage allows their loved ones to stay living in the family home, relieving financial pressure and additional trauma.

- If you have children. People with children are strongly recommended to have life insurance so that there’s money to take care of the kids, and the remaining living partner if one of the caregivers dies or gets ill. Having life insurance means having enough money so that your kids don’t suffer unnecessarily.

At Pinnacle Life, we believe life insurance should be accessible to anyone who wants it. That means we offer value for money life cover, all online and in plain English. If you don't think you need it, then still think about what else you might need, for example, a will, power of attorney or enduring power of attorney.