When it comes to choosing a Life Insurance provider, it can be difficult. Especially if it’s your first time taking out a policy. Insurance prepares you for the things you don’t see coming, the unexpected; usually, the things you hope won’t happen. Whether it’s getting seriously ill, injured, or even dying, having life cover in place can ensure you’re prepared to cope.

That’s why it’s important that you get it right.

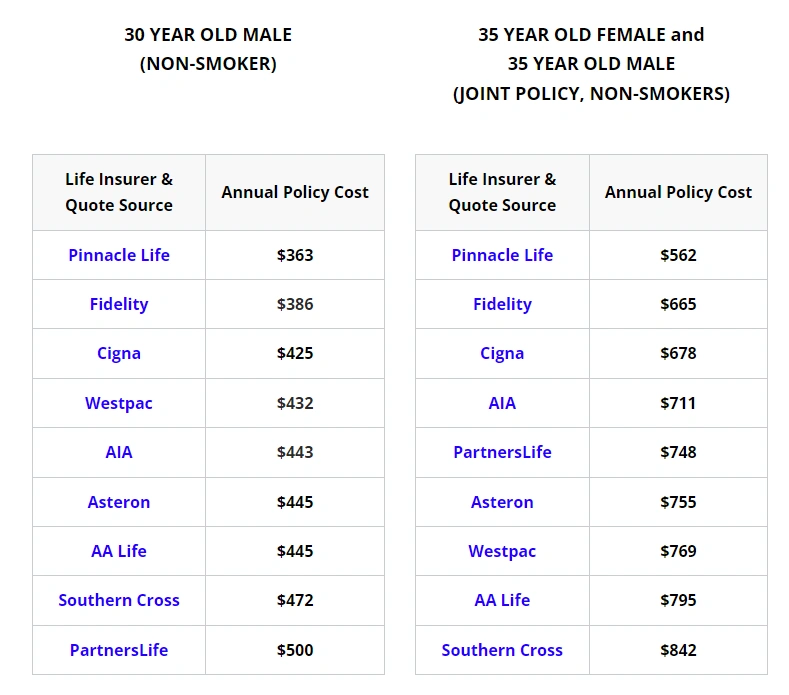

Like anything we buy, it’s a good idea to shop around and see who is offering the price that suits us best. We know from our customer research that value for money is particularly important, which is why at Pinnacle Life, we offer the most affordable life insurance in New Zealand, as recently confirmed by MoneyHub.co.nz. The study consisted of multiple quotes from 10 different insurers, identifying Pinnacle Life as the most cost-effective provider for both an individual and joint policy.

We know good decisions last lifetimes, and at Pinnacle, we want you to be confident you got it right. We also believe life insurance should be affordable for all Kiwis. But we completely get it if you want to shop around first!

When it comes to doing your research on different insurance providers, some websites advise you not to go direct to an insurer. They say you'll pay full price and have nothing to compare it with. We disagree. We believe 'it’s important you do your own homework. Approach a few insurers directly and understand what they offer. Then make your own comparisons. If you have a special health need or family situation, then it might be helpful to talk to an expert. For most people, however, there's no reason why you can't choose for yourself. Here are some tips on how you can pick your next provider:

- Start by making a list of providers –It’s easier to begin by grouping all potential providers together through sources such as friends, family, and online media. This way, you can make a list of providers to compare against.

- Collect Quotes – By now you should have an idea of how much life cover you will need, so you can begin to compare quotes from your list of providers using your own personal details to calculate your premium. You can find your quote with Pinnacle right here.

- Financial stability of the company - Make sure the company is financially stable and has a strong rating from independent rating agencies such as A.M. Best or Standard & Poor's. Ratings of each provider usually come down to their financial holdings and how much is collected in premiums. Pinnacle Life Limited is rated 'B' in financial strength (outlook ‘stable’).

- Customer Service & Support – The support you receive is so important in helping you understand your coverage, and the claim process, and resolving any issues or concerns you may have. Checking reviews on Google and Facebook is an ideal glass door to see how well some companies’ customer service teams operate. You can also check independent review websites such as Feefo . Pinnacle Life just received the Feefo Trusted Service Award.