Life’s journey is full of surprises, both good and not-so-good, and the not-so-good can be hard to discuss or even think about. But just because it’s difficult doesn’t mean you should turn a blind eye to these possibilities. That’s where Pinnacle Life steps in - we’re here to help you create your ‘Plan B’ - a roadmap for security that ensures you and your loved ones are protected, no matter what life throws your way.

Choosing what insurance you need

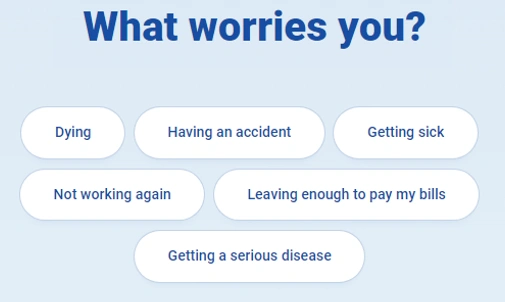

What matters most to you?

The first step in making your Plan B is choosing the right insurance. Your choice depends on your unique needs and priorities. Consider what matters most to you and your family. Each type of insurance serves a distinct purpose, and understanding their significance and their differences can help you make an informed decision. Your choice matters because it forms the foundation of your financial safety net.

If you’re worried about dying and making sure there is enough money for your bills to be paid, this is the cover for you. This cover ensures your family are safe and financially secure if you pass away, providing security for their future.

If you're worried about the financial consequences of getting sick or a serious disease, this cover will protect you. As an add-on to life insurance cover, it offers financial support if you’re diagnosed with a critical illness, allowing you to focus on your recovery instead of the financial impact. You can read the 24 conditions that are covered here.

If you’re worried about having an accident and not being able to work then disability cover can be added onto your life insurance cover. This provides a safety net if you become unable to work if you become totally and permanently disabled.

If you’re worried about losing your job from illness or injury, income protection can be the safety net you need to maintain your financial stability, looking after your bills while you recover.

Assessing your needs and choosing how much cover

Once you’ve identified what’s important to you and your family, it’s time to assess your financial situation. This step is crucial because it helps determine how much cover you need - and how much you can comfortably afford. Our online advice tool, licensed by the Financial Market Authority, provides personalised financial guidance on the ideal cover amount based on your financial situation. By calculating your income, assets and debts, this tool helps you arrive at the perfect cover figure for your situation. This assessment simplifies the decision-making process, making choosing the right cover to protect yourself and your loved ones easier.

Putting it in place

With a clear understanding of your needs, it’s time to find the right policy. Research and compare insurance providers and policies to ensure you make an informed choice. Look for a provider with a solid reputation and consider customer reviews and ratings. Earlier this year a study by MoneyHub found Pinnacle Life the most cost-effective life insurance provider, you can read more about that here. The article also covers helpful information on what research you need to do to choose your life insurance provider.

The application process

Once you’ve selected your policy, it’s time to apply! The application process involves submitting personal information. With Pinnacle Life you can fill out the application all online. This will take you through a series of questions, taking around 10 minutes. If you get stuck or need help with your application, you can talk to our team by calling or requesting a call-back.

In some cases, depending on your personal information, we may need to clarify some information with you, get more information from your doctor or have an underwriter review your application. Underwriting is when the insurance provider assesses your application in detail, considering factors like your health, age, and lifestyle to determine your eligibility and premium rates - you can read more about it here. At Pinnacle we underwrite most applications directly online but sometimes, when the software can’t make the underwriting decision, a human underwriter will need to review the application. Either way, be assured that our team will be here to help you with any questions, requests or concerns that you may have.

Telling your family

Don’t keep your Plan B a secret. Discuss your insurance decisions with your family so they are aware of the protection you have in place. This ensures they know what to do in the case the unexpected happens, making the process smoother and less stressful. You can be assured that we’ll look after you and your family - we’ve paid out 97.6% (as at 31st July) of the claims made on our policies - you can read more about our claims process here.

A well-structured Plan B provides peace of mind and financial security for you and your family. It’s your safeguard against life’s uncertainties. With the right cover, you can embrace the future with confidence.