In this week’s blog, we wanted to keep you in the loop with some exciting news and views from the Pinnacle Life team - an update from us!

At Pinnacle Life we are dedicated to making it simpler for Kiwis to get life insurance and for us to keep doing that, we are constantly looking for ways to improve and be on top of our game. The following updates truly represent the fruits of our staff’s hard work to make life insurance simple and accessible for all of Aotearoa. We hope you find something that interests you in our good news.

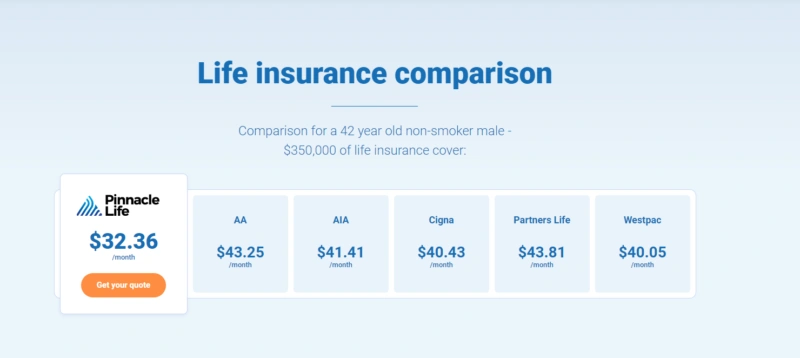

Pinnacle Life Named Most Cost-Effective Life Insurance Provider

Earlier this year MoneyHub compared life insurance quotes from a range of NZ life insurance companies. The study consisted of multiple quotes from 10 different insurers, identifying Pinnacle Life as the most cost-effective provider for both an individual and joint policy.

Like anything we buy, it’s a good idea to shop around first and see who is offering the best value. Life Insurance is no different. This is why we regularly check competitor prices to understand where we’re placed in the market so that we know we’re offering great value. It can be tricky to compare as everyone offers different discounts, payment options, and premium structures. You can read more about choosing a provider and the MoneyHub results here.

Introducing our new partner Quashed!

We are thrilled to announce our new partnership with Quashed. The Quashed platform gives users the ability to compare insurance (life, vehicle, contents, house, pet) from different insurers using their Market Scan function. Pinnacle Life now joins AIA on the list of Life Insurance providers on the Quashed portal. As mentioned earlier in the blog, we want Kiwis to compare and find the provider that suits them the best!

Quashed was launched in 2020 with the aim to make insurance simpler and more accessible to Kiwis online. Just like us! Along with the market scan function, they also have an option for Quashed customers to upload copies of their insurance policies to allow for visibility in one central location. Think of it as a wallet for all your insurance policies.

The website is very easy to use, so check it out for your other insurance needs.

AM Best Upgrades our Credit Rating

AM Best has revised the outlooks of our credit ratings from stable to positive and upgraded our Financial Strength Rating to B+ (Good) from B (Fair) and the Long-Term Issuer Credit Rating to “bbb-” (Good) from “bb+” (Fair).

We are pleased to see our efforts in this area recognized. AM Best reported that improved outlooks reflected an upward trend in Pinnacle Life’s balance-sheet fundamentals, including its regulatory solvency – which experienced some volatility in recent years due to new business growth initiatives – and strengthened financial flexibility following the change of ownership.

As always, everything we do at Pinnacle Life is centered around making it easier for Kiwis to understand, buy and manage their life and living insurance needs. If you are thinking of taking out a policy, why not start your journey with us today and calculate your own quote or try out our digital advice tool to help guide you in the right direction if you want to learn more about what is right for you.