This article on predictive testing for Alzheimer’s got me thinking.

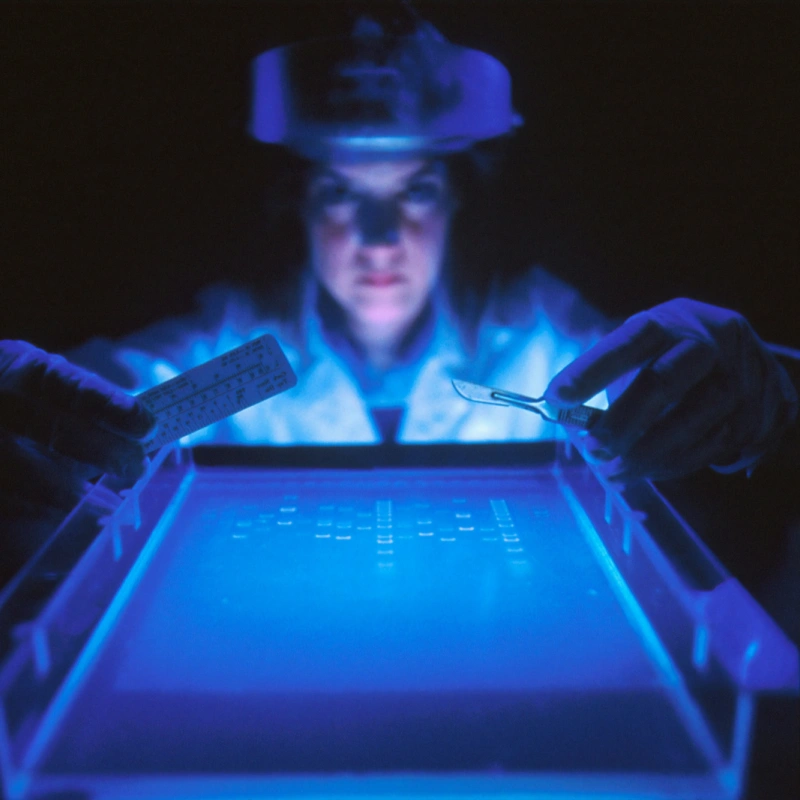

Genetic testing and screening techniques for a whole range of potentially deadly diseases are just around the corner. We’ll soon know just how disposed we each are to dying of any number of diseases, simply through testing. So what does this mean for the world of life insurance?

The point of life insurance is to protect ourselves against the unknown. We don’t know when we’ll die and we don’t know what will cause us to die… so we take out life insurance. And what we pay for life insurance is based on statistics. This is the domain of those mysterious people called ‘actuaries’. Life insurers gamble on the fact that if our parents lived to a ripe old age and we have no symptoms of ill health today and we lead a good clean lifestyle, then we are likely to live at least as long as the average in our population. In effect, the life insurer takes a calculated risk.

But what if tests could prove that in spite of my apparent health, I am likely to die of a specific disease… and that I am not likely to live as long as the average person? What happens when life insurers get this information? What happens when the 'unknown' becomes the 'known'???

Quite simply, life insurers will use the info to calculate my risk. My genetic conditions would probably be treated as 'pre-existing conditions'. The insurer would likely either exclude the genetic conditions indicated by the testing or they may charge me higher insurance premiums.... and this starts to cut across the very reason I want life insurance - I want the life insurance company to cover my risk of dying - not exclude or load them?

Potentially life insurers would move from 'pooling risk'... to 'excluding' risk.

A lot of water yet to flow under this bridge, to be sure. Interested in your views....?

(See this article on the benefits and risks of genetic testing)