A couple of weeks ago, this reporting from Radio NZ caught our attention (watch the full video here). Clearly this reporter thinks it’s cheaper to insure her car than her life. Which made us question, is it?

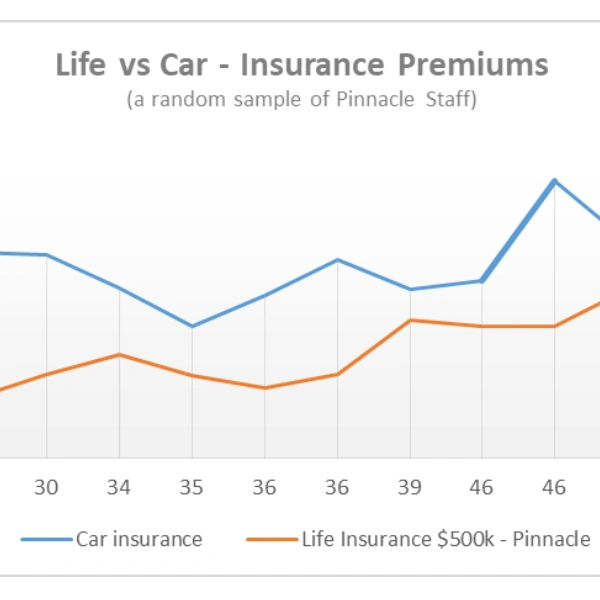

So, we decided to do some digging. We started off by asking our staff how much their car insurance was and compared it to how much they would pay for Pinnacle Life cover. We’re a small team so we only had a small sample size, but we range in age from 30 - 50, have smokers and non-smokers and are male and female. Our cars range from a Suzuki swift (NZ”s most popular car), to a BMW, to a Mazda CX9.

We found that life insurance is much cheaper than car insurance for people in their 30’s and 40’s (see the graph above).

The maximum car insurance monthly premium was $88.62 (the CX9) and the maximum life insurance premium for $500,000 of cover was the 50 year old at $62.70.

Life cover for our 50 year old was significantly the most expensive. Life insurance gets more expensive as you get older. That’s because we are more likely to have issues with our health as we age, increasing our risk of dying or falling seriously ill.

The key time to have life insurance is usually when we’re in our 30’s and 40’s when our kids are still dependent and we have big debts. If the worst was to happen at this time our families could be financially devastated without life insurance. As we get older, our kids become financially independent and we pay off our mortgages so our need for life insurance becomes less. We can often look to reduce the amount of life cover we have as our needs change.

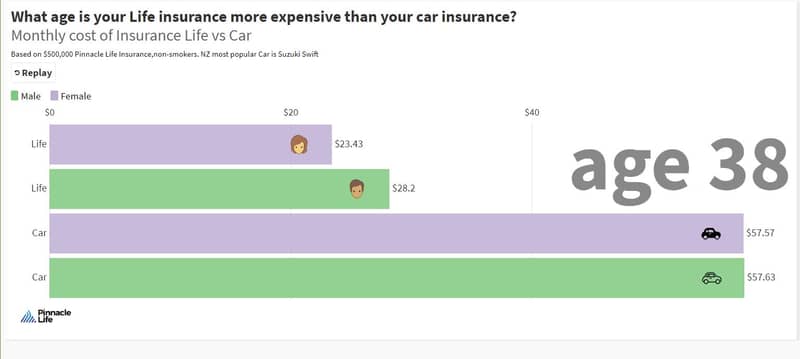

Our cars follow a different pattern. The most expensive time to have car insurance is under 25, then it gets cheaper and cheaper as we get older. (However, we also tend to upgrade our cars so our car insurance premiums don’t always decrease over time.) Click on the image below to watch how premiums change for both car and life insurance as you get older.

There are lots of ‘levers’ we can choose from to influence the cost of our insurance for both car insurance and life insurance. For life insurance it’s the amount of cover we choose and the ‘add-ons’ we select, like an illness benefit or accidental death cover. For car insurance it’s the type of cover we have (3rd party, fire and theft or full cover) and the amount of excess, as well as add-ons such as windscreen cover or roadside assistance.

For some, car insurance may well be cheaper than life insurance. But we don’t think it’s as obvious as ‘of course it’s cheaper.’ This is just one of the assumptions about life cover that stop people from finding out more and doing something about getting themselves covered.

Maybe we’re different at Pinnacle Life? Because we keep things simple and because we are an online company, it costs us less to run our business. We pass the benefits onto you, our customers, by way of lower premiums. Because you buy direct from us when you buy online, we don’t pay commissions either. We try hard to be great value so we were a bit upset that it was ‘obvious’ that life insurance was more expensive than car insurance. We don’t think it’s quite that straight forward. What do you think?