Life is a bumpy ride filled with ups and downs, it’s a truly unique yet unpredictable journey. Sometimes there are unforeseen twists and turns that can catch us off guard and leave us vulnerable. Among the many uncertainties, life throws our way, financial stability is a paramount concern. Our ability to earn an income is undoubtedly the cornerstone of our financial well-being, enabling us to meet essential needs and build a secure future for ourselves and our loved ones. So, what do you do when life gives you a raw deal and your ability to earn is interrupted? Enter Income Protection.

You’ve been told it’s a good idea to have it, but why? It sits on a long list of financial jargon that could be written in plainer English to make it easier for everyone to understand. Well, fear not, in this blog, we’ll delve into the basics of income protection and why it may or may not fit into your financial plan.

What is Income Protection?

Long story short, Income Protection insurance takes care of you and your family if you become temporarily unable to work due to an accident, illness, or injury. It means you receive a monthly payment to account for your loss of earnings to ensure that life’s necessities can be paid for as usual until you’ve recovered.

How much will I be paid?

You can choose the monthly payment amount that will be right for you, with the choice of either 60% or 75% of your current average monthly income (before tax) up to a maximum of $12k per month. You can also choose how long you want payments to continue after you’ve had to stop work (6/12/24/36 months). On top of that, you can also decide how long you want to wait for your first payment (30/60/90 days) from the time you are unable to work. These choices will affect your premium which is why we recommend using our quote tool to find the combination and price that suits you best.

What if things change at work?

Everyone’s work situation can change from time to time which is why your policy will allow for change.

- If your income goes up or down your level of cover can too. You just need to let us know within 60 days of when your new income becomes effective. Alternatively, you can apply for an increase/decrease at any time.

- If you are made redundant while your policy is in place, we'll pay your premiums for up to 6 months while you're looking for another job.

Understanding ACC vs Income Protection

When it comes to ACC, it is more specific in what it covers, and won't cover illnesses or anything that isn't an injury. If the time comes that you do unfortunately have an accident and injure yourself, ACC will pay medical costs, physiotherapy treatment, and up to 80% of the pre-injury salary is paid until you can return to work.

However, if the injury is complicated by a pre-existing condition, then all entitlements (care, recovery, and compensation) may be denied. It also will not provide for you if you become ill, and the most likely reason that you may not be able to work for an extended period of time is illness. That is when your Income Protection will save the day as you will be fully covered. Income protection does not discriminate between injury or illness.

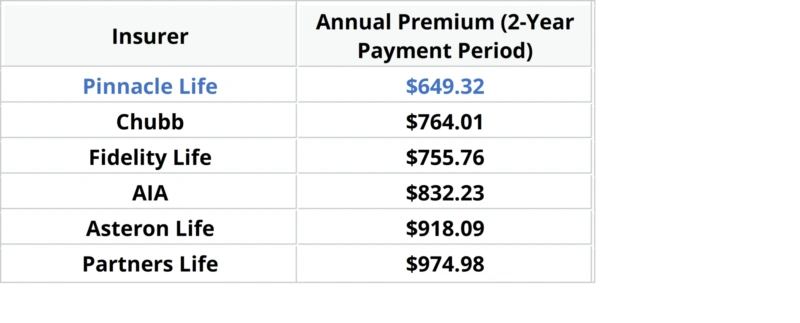

Pinnacle is the most cost-effective Income Protection provider in New Zealand

If you are thinking of taking out Income Protection, it is always important to shop around and find the insurance provider that suits you best. We get that! But we just wanted to let you know that Pinnacle Life is the most cost-effective income protection provider. Take the below example of an Annual Premium for a 35-year-old, Non-Smoking, Accountant:

If you would like a personalized quote, check out our online quote tool that gives you a price in just 30 seconds! Click here if you would like more information on Income Protection.