The Kiwi ‘she’ll be right attitude’ flies in the face of needing Life Insurance. Which means we are significantly under-insured, especially in Auckland, or if we’re aged over 55.

‘How much Life Insurance do I need?’ is a question we get asked a lot at Pinnacle Life. The answer is, that it depends, which, we know, is a bit vague. It’s not complicated it just needs a bit of thought. You need to think about what you or your family might need now, or in the future if something were to happen to you. To work that out, you need to think about

- whether you have a mortgage or other debt to repay,

- how much income you would need to replace and for how long, and

- any other costs you want to prepare for, such as education or family holidays.

You should also consider whether you have other savings or sources of income that would still be available to your family after your death. For a simple calculator to help you work it out click here.

Often the biggest thing for people to cover is their mortgage. If the mortgage can’t be repaid in the event of a death that can often mean that the remaining partner can’t afford to continue paying the mortgage on their own. This may mean the family home has to be sold, which can be very unsettling, and terrifying, at what is already a stressful time. Making sure your Life Insurance is more than your mortgage is a good starting point for whether you have enough cover.

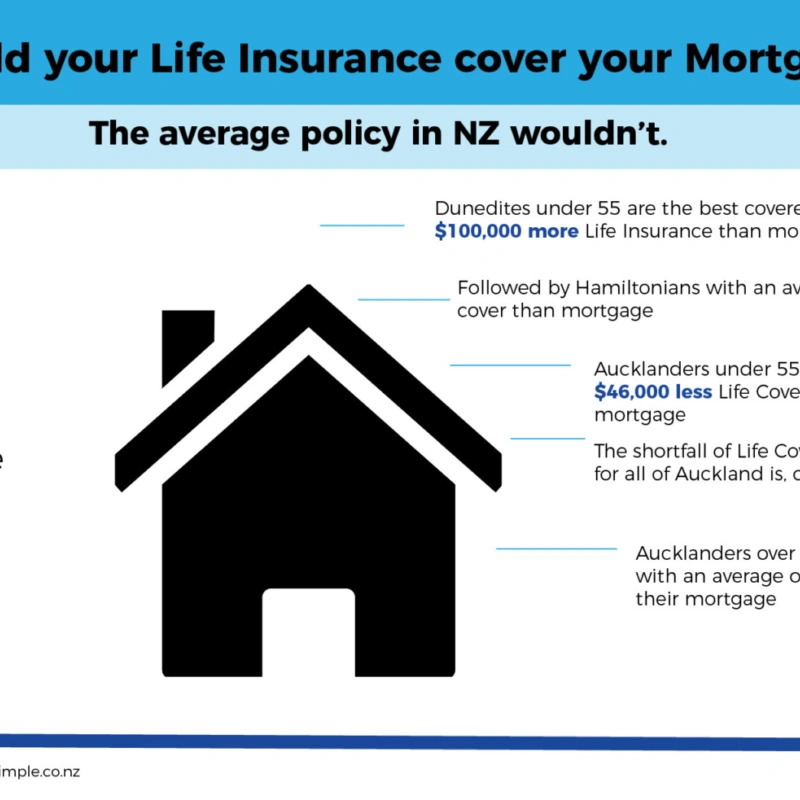

At Pinnacle Life we looked up the average mortgage debt by region and compared it to our average life cover. We found that

- Aucklanders younger than 55 had an average of $46,000 less cover than the average mortgage,

- The average cover for all Auckland regions was $68,000 less than the average mortgage

- Outside of Auckland, people younger than 55 could pay off their mortgage and have some money left over.

- Dunedin folk younger than 55 were the best covered with an average of $100,000 left over after paying off the average mortgage but those over 55 could be caught short.

- The most under-insured group are those over 55 in Auckland with a shortfall to pay off their mortgage with an average of $91,000.

- Outside of Auckland and over 55, the only regions not under-insured compared to the average mortgage are those living in Lower Hutt and Christchurch.

Ok, so we’re only talking about the Pinnacle Life customer base and these numbers are averages of averages (our actuary might have a conniption about statistics), but it still paints a grim picture, most of us seem to be significantly under-insured.

In 2011 Massey University and the NZ Financial Services Council conducted some research into Under-Insurance in NZ. They found that while we didn’t have, what they called, a ‘crisis of cover’ we did have poorly chosen levels of cover. That our level of cover didn’t correspond to our financial vulnerability, i.e. we don’t have the right amount of cover for our needs. They concluded that we kiwis make vague guesses about how much we need rather than working it out.

Looking at average mortgage versus Life Cover numbers, it seems this is what we need to get better at. Taking the time to work out what the needs of our own family rather than ‘taking a stab’.

Significant lifetime events such as, getting married, having children, changing jobs or buying a house, are usually a good time to think about Life Insurance. At each of these points you might find you need more cover than you currently have. Then at some point the outcomes of such significant events change and you can start decreasing your cover, for example you pay off the mortgage, your kids leave home etc.

Take the time to work out what would suit your family especially if you’re an Aucklander or if you live in Dunedin. In Auckland you might find you need more than you have but in Dunedin you might be able to decrease your cover and still be well prepared should the worst happen.