How much cover do you need?

What type of cover should you choose? How much will it cost?

These are usually the first questions people are trying to answer, so if this is you, you’re not alone, and you’ve come to the right place!

Our online digital advice tool can help.

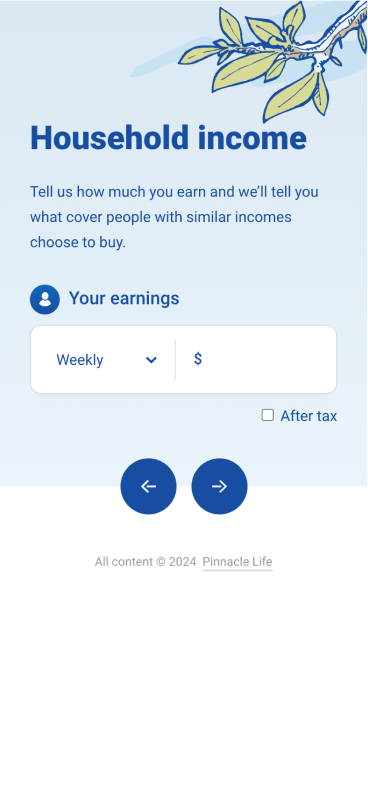

Our tool will ask you a few simple questions about your life, goals and financial situation the tool then calculates what type and amount of cover could suit you best. You’ll get a personalised recommendation - so you can feel more confident about how much cover you need.

If you're not ready, more of our other tips, tools and resources can help you get a ballpark of how much cover you may need.

Life Insurance - the basics in 5 minutes

Understanding the basics of life insurance doesn’t have to be daunting. In just five minutes we’ll guide you through the key points making the process simple and straightforward. Download our e-book or watch our videos for an intro to Pinnacle Life Insurance.

How much life insurance do other people have?

When you're trying to figure out how much life insurance you need, seeing what other people have can be helpful.

Let us know your gender and age, and we will show you what life insurance other people like you have looked at. This is a great starting point for what might be right for you. We've accessed over 154,000 quotes over two years, so you'll get a good ballpark.

When you're trying to figure out how much life insurance you need, seeing what other people have can be helpful.

Let us know your gender and age, and we will show you what life insurance other people like you have looked at. This is a great starting point for what might be right for you. We've accessed over 154,000 quotes over two years, so you'll get a good ballpark.

We’ve designed our tools and calculators to help you be confident about what cover you need.

-

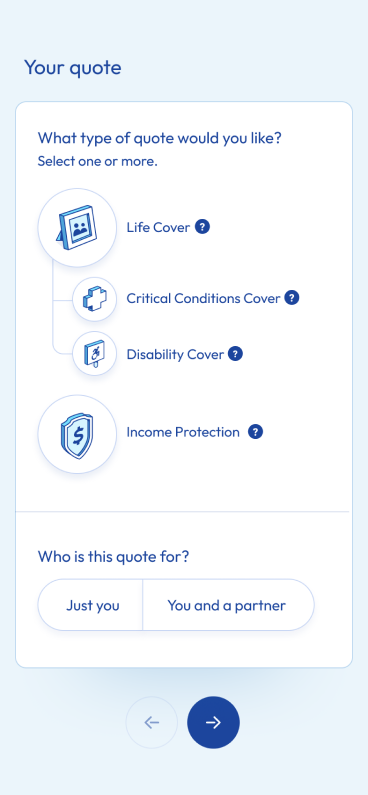

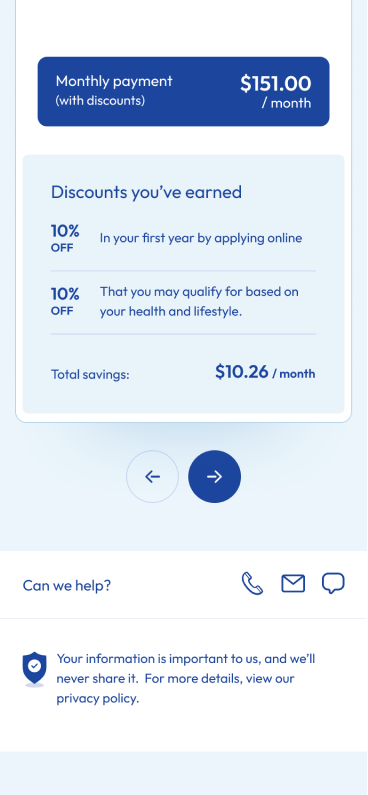

Quote calculator

Already have number in mind? Get a quick and simple breakdown of how much different payment amounts will cost you.

-

Free Life Insurance advice tool

Need help determining how much insurance you need? Our advice tool will step you through the process and give you a couple of options so you can be sure you know what's right for you.

How it works

If you change your mind within 30 days, we guarantee a full refund - no questions asked.

-

1

Get a quote

Select your products and add a few details to get started (you can edit products later). Adjust your lump sum payout amount and monthly premiums to find the right balance for you.

-

2

Apply online

We’ll ask you some health and lifestyle questions; depending on your answers, you could be covered in just 10 minutes.

-

3

Get covered

We’ll email you your policy. Your cover starts immediately, provided we receive your first payment within 14 days.

Frequently asked questions

For more commonly asked questions answered, click here.

How do you work out how much premium I pay?

How do you work out how much premium I pay?

Premiums are calculated based on several factors, including your age, gender, smoking status, medical history, some lifestyle factors, and how much cover you need. Actuaries work out the likelihood of you needing to make a claim based on all these factors and set the premiums accordingly. There are some things you can do to control what you pay, including not smoking, maintaining a healthy weight and not undertaking risky activities, like sky diving or rock climbing. The amount of cover you choose also affects your premium, more cover will cost more.

What are your age limits?

What are your age limits?

We offer cover to people aged between 18 and 75. Specifically, the age limits are:

For Life Insurance

- you can apply online if you are aged 20-69

- or by talking to us if you are 18-74.

- You can be living in NZ, Australia, USA, Canada, UK, Ireland, Hong Kong or Singapore.

For Income Protection

- you can apply if you are 20-59 and,

- living and working in NZ.

For Critical Conditions (note you can only apply for Critical Conditions at the same time that you apply for life insurance)

- You can apply online if you are age 20-59

For Disability Cover (note you can only apply for Disability Cover at the same time that you apply for life insurance)

- You can apply online if you are age 20-59

Does it matter if I have other life cover policies?

Does it matter if I have other life cover policies?

No. You can have as many policies as you like with as many companies as you like.

Can I get cover for my parent/partner?

Can I get cover for my parent/partner?

Yes, they simply need to apply. Note that it's the person getting insured who must provide the answers to the health questions on the application form and complete the declaration. When the policy is issued, the insured person will also be the policy owner. If they want to change that, they will need to request an update using the 'change of ownership' form included in the policy.

What are your cover limits?

What are your cover limits?

For Life Insurance

- if you apply online you can get cover from $50,000 to $1,500,000.

- If you’d like to apply for cover of under $50,000 or up to $2 million contact our office (there will be some extra medical check requirements for the higher cover levels).

For Income Protection

- Your Income Protection Cover amount cannot exceed 75% of your monthly income or $15,000 per month.

- There are also limits depending on the age of the life insured :

- When covering 40% of the insured person’s monthly income, our cover limit is:

- $8,000 per month if the insured person is aged 20 to 50,

- $6,670 per month if they are aged 51 to 54 and

- $5,340 per month if they’re aged 55 to 65.

- When covering 60% of the insured person’s monthly income, our cover limit is:

- $12,000 per month if the insured person is aged 20 to 50,

- $10,000 per month if they are aged 51 to 54

- $8,000 per month if they’re aged 55 to 65.

- When covering 75% of the insured person’s monthly income, our cover limit is:

- $15,000 per month if the insured person is aged 20 to 50,

- $12,500 per month if they are aged 51 to 54 and $

- 10,000 per month if they are aged 55 to 65.

- When covering 40% of the insured person’s monthly income, our cover limit is:

Where can I find Pinnacle Lifes' Terms and Conditions and Privacy Policy?

Where can I find Pinnacle Lifes' Terms and Conditions and Privacy Policy?

You can find our terms and conditions here and our privacy policy here.

What's your financial strength rating?

What's your financial strength rating?

A.M Best rates Pinnacle Life Limited 'B+' financial strength (Good) and a bbb- issuer credit rating (outlook 'stable') at 1 May 2024. Our financial strength rating is important because it lets you know whether you can rely on us to be there when you need us.

You may also want to know that Pinnacle Life is reinsured by Hannover Life Re of Australasia Ltd, which is part of the global group Hannover Re, one of the five largest reinsurance groups in the world. Reinsurance is important because it allows insurance companies to spread risk, meaning they are unlikely to get overwhelmed if claims are unusually high. Hannover Re’s financial strength rating can be found here.

Our customers say the loveliest things

View all reviewsGave good advice and followed up quickly.

Jash was amazing with commutation. Patient and understanding.

Very easy, first time ever Life insurance was easy. Other providers had equal opportunity but couldn't provide a confirmed quote a month after I applied.

I needed to transfer ownership of my life policy to myself as my wife has passed. I had last year claimed her life policy where the process was straight forward and I received the payout was prompt.

Great service,

Easy access,

Friendliness.