We understand your income is your lifeline

Protecting your income is crucial, but it can be confusing to navigate the options available. That's where we come in. Pinnacle's Income Protection is designed to be simple, affordable, and tailored to your needs. It ensures you have a safety net if you're unable to work due to illness or injury.

Income Protection Basics

Policy summary

Our Pinnacle Income Protection Cover is an insurance policy that replaces a pre-agreed portion of your income if you are unable to work due to illness or injury.

Income protection provides financial security, allowing you to focus on your recovery without the stress of lost income. You must have have been in paid employment in NZ for the past 2 years to apply.

Change your mind within 30 days of starting your Pinnacle Income Protection policy? We’ll refund your money, no questions asked.

What's covered?

Comprehensive cover including a wide range of illnesses and injuries as long as a doctor confirms that you cannot perform all your usual work duties due to that illness or injury.

A monthly payment if you can’t work because you’re sick or injured. You'll receive a pre-agreed percentage (up to 75%) of your pre-tax income if you're unable to work.

You choose the percentage of your pre-tax income covered (up to 75%), the length of time you receive payments, and the waiting period before payments start.

What’s not covered?

We do not cover dangerous activities (like base jumping) or risky occupations (like deployed military personnel).

You can’t claim if you are made redundant or can’t work due to a mental illness or a normal pregnancy.

Depending on your health and lifestyle other exclusions may be added to your policy.

*More details are in the application process and your policy document.

Your privacy

Your information is important to us. We will never share your information.

For more details view our Privacy Policy.

When does your cover end?

Your Income Protection cover will continue as long as you keep making payments, and will end on the last day of the month in which you turn 65 or the day you pass away.

You may also choose to cancel your policy at any time.

When you need to claim

- Contact us if you have an injury or illness that means you can't work, and we'll help you through the claim process.

- After your waiting period is finished, your first payment will be made on the last day of the month following.

- Payments will be offset by any other income you are receiving from paid sick leave, other insurance policies, ACC or any other government agency.

- We’ll keep making monthly payments until you reach the end of your chosen claim period or until you return to work (whichever happens first).

- Your policy will be reinsured by Hannover Life Re, one of the world's largest reinsurers of life insurance.

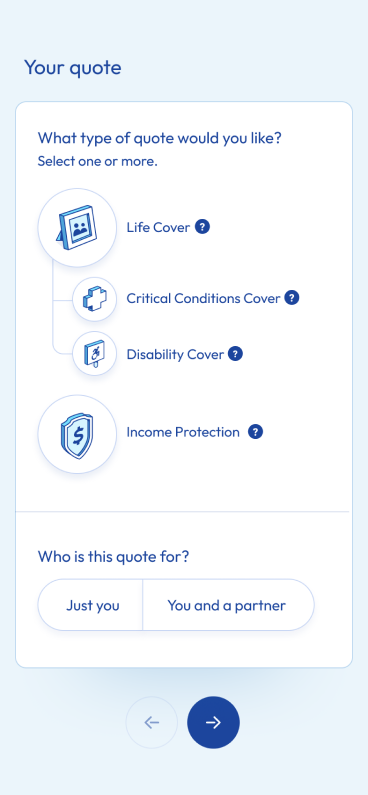

Additional insurance products by Pinnacle Life

Life Insurance

Life insurance provides for those you leave behind. It helps them pay the mortgage, invest in education, put food on the table, and pay the bills.

Disability Cover

Having Total and Permanent Disability cover means that if you become permanently unable to work, or meet our Total and Permanent Disability definitions due to accident or illness, you will receive a lump sum payment to use however you need.

Critical Conditions Cover

Having Critical Conditions Cover means that if you suffer from one of the 38 conditions specified in your policy, you will receive a lump sum payment to use however you need.

Our customers say the loveliest things

View all reviewsGreat service and to talk to very helpful.

Excellent, clear, concise communication. Always asked questions so I could clearly understand. I highly recommend it to my friends and family. So helpful in all aspects of life insurance.

Quick and easy questionnaire to get a policy started.

Easy Sign Up.

Clear and easy to read questions.

No Hassle.

Quick response and communication.

Fantastic. The online process for setting up a policy was thorough and user friendly. All information and documentation provided was quick and comprehensive including direct debit payment option. The next day I received a call, from a real person ( sadly unique in itself now) but Eddie was easy to hear, understand and talk to on the phone. He provided additional information and paperwork quickly and efficiently. I have already recommended Pinnacle to friends and its only been a few days. Thank you for such a seamless process.

Get covered in 3 easy steps

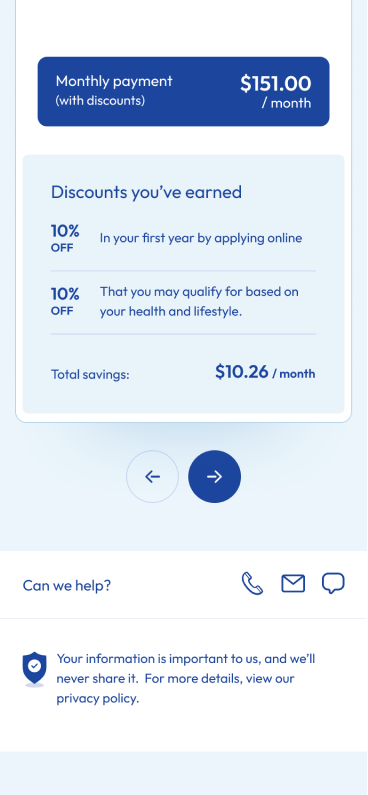

If you change your mind in 30 days, we guarantee a full refund - no questions asked

-

1

Get a quote

Select your products and add a few details to get started (you can edit products later). Adjust your lump sum payout amount and monthly premiums to find the right balance for you.

-

2

Apply online

We’ll ask you some health and lifestyle questions; depending on your answers, you could be covered in just 10 minutes.

-

3

Get covered

We’ll email you your policy. Your cover starts immediately, provided we receive your first payment within 14 days.

Need help working out how much cover is right?

What type of cover should you choose? How much cover should you get? How much will it cost? For many people, this is where buying insurance gets complicated and overwhelming. We've got the tools to help.

Frequently asked questions

What are your age limits?

What are your age limits?

We offer cover to people aged between 18 and 75. Specifically, the age limits are:

For Life Insurance

- you can apply online if you are aged 20-69

- or by talking to us if you are 18-74.

- You can be living in NZ, Australia, USA, Canada, UK, Ireland, Hong Kong or Singapore.

For Income Protection

- you can apply if you are 20-59 and,

- living and working in NZ.

For Critical Conditions (note you can only apply for Critical Conditions at the same time that you apply for life insurance)

- You can apply online if you are age 20-59

For Disability Cover (note you can only apply for Disability Cover at the same time that you apply for life insurance)

- You can apply online if you are age 20-59

What’s the difference between Life Insurance and Income Protection cover?

What’s the difference between Life Insurance and Income Protection cover?

Life insurance provides a one-time payment if you die or are diagnosed with a terminal illness, while income protection provides regular payments to replace part of your income if you can't work due to illness or injury. At Pinnacle Life, you can purchase both types of cover together or separately, depending on your needs.

What is the difference between income protection and ACC?

What is the difference between income protection and ACC?

The main difference between ACC and Income Protection cover is that ACC covers loss of income due to accidents but not for illnesses, while Income Protection covers both accidents and illnesses.

What does income protection cover?

What does income protection cover?

Income protection helps replace part of your income if you can't work due to illness or injury. At Pinnacle Life our Income Protection policy will cover up to 75% of your income.

It's also important to note that some situations aren't covered, like pre-existing conditions, self-inflicted injuries, mental health conditions, redundancy, and certain dangerous jobs or hobbies.

How much does income protection insurance cost?

How much does income protection insurance cost?

Income Protection monthly premiums are based on the cover you want, how long you want to wait before your payments kick in and how long you want the payments to continue. You choose these when you take out cover. Get a personalised quote in just 30 seconds to find out exactly what it would cost you.

How long does it take to get income protection?

How long does it take to get income protection?

Applying for Pinnacle Life Income Protection cover can take as little as 10 minutes. Most customers will be covered instantly, but sometimes, we may ask for more information.

Can I get income protection if I am self-employed?

Can I get income protection if I am self-employed?

Yes, you can get Income Protection if you're self-employed as long as you’ve been averaging working at least 30 hours per week over a two-year period.

How do I apply for income protection with Pinnacle?

How do I apply for income protection with Pinnacle?

Apply online for Income Protection cover in just 10 minutes. Get a personalised quote in 30 seconds by entering some basic details - your gender, age, and smoking status.

Then customise your cover by adjusting:

● The percentage of your pre-tax income covered (up to 75%)

● The length of time you receive payments

● The waiting period before payments start.

When you're happy with your cover and monthly premium, answer a few health questions, set up your payment, and you're covered!

Need help? Our team is here to support you every step of the way. Contact us here.

Choose Pinnacle Life for proven, award-winning life insurance that has been safeguarding Kiwis for over two decades.

Experience the peace of mind that comes with affordable, simple and secure life insurance cover.