Talking about life insurance means talking about death. No-one finds that easy. Pinnacle Life has some tips to get you started with talking about money and life insurance with your partner.

Not many of us have been taught how to have conversations about financial decisions. In fact, financial literacy hasn’t been on the school curriculum for very long at all – at best, it’s still optional for most schools today. There seems to be an underlying assumption that financial literacy is something you can learn yourself or pick up from your parents. But evidence suggests it’s not that easy; New Zealanders are notoriously underinsured and ‘under-saved’.

In a time when the news is filled with death rates, recessions and industry failures and many of us are facing reduced incomes, it’s a reminder that it’s never too soon or too late to start having conversations about our finances and insurance. We know that it's not easy to talk about money openly and honestly; talking about life insurance can be even harder because it means talking about what will happen if you die.

If you’ve never talked with your partner about money or life insurance or you’ve tried and been rebuffed, don’t be put off.

The tips:

1. Do your own research first

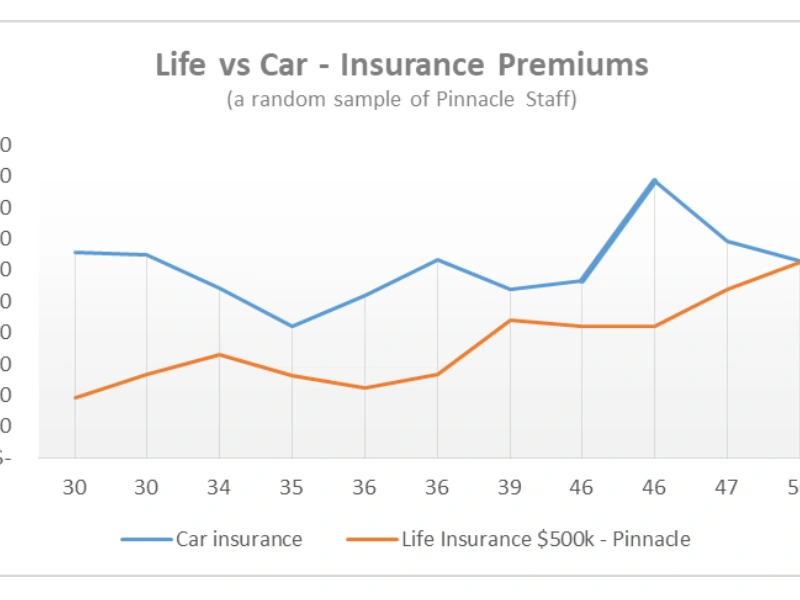

There’s nothing more likely to stall the conversation at the first hurdle if you’re not sure you want to talk about it either. Doing some initial research on your own will help you to feel more confident about what you want to talk about and what’s important to you. Visit the Pinnacle Life website for calculators and general information about life insurance or try Sorted or Life-Info.

Bringing up the consequences of your untimely demise is probably not going to get the attention you’re hoping for if your partner is stressed, time-poor or in the middle of watching their favourite sport. Try to find the time where both of you will be undisturbed and able to focus. That may mean setting up a ‘money date night’ if you struggle to find time to spend together where you are both relaxed and able to concentrate.

3. Take your time

It’s unlikely that you will reach agreement on your financial goals and plan in 10 minutes, especially if you’ve never talked about it before, so don’t rush. Be calm and know that the goal is to have a shared plan. Talking openly might spark disagreements that you need to back away from, consider and come back too.

4. Start with the big picture

When you start talking to your partner, start with the big picture. What are your hopes and dreams for the future? Where would you like to live if you could live anywhere? Do you want children or more children than you have already? When do you hope to retire? What would you hope for each other if one of you were to die? Once you have a shared vision, it becomes easier to start talking about money.

5. Get emotional

Talking about your future, and the future of your partner and your children should be emotional, so don’t be afraid of it. It’s emotional because you care and you believe that it's important, that’s why you’re having the conversation. Allow your emotions to help you work out what’s important but don’t let it drive your decision making; try to stay objective.

6. Talk about money

For those of us who work in banking or insurance, talking about money in general terms becomes easy. That’s because it’s not ours! Thinking and talking about your own finances can be a lot harder because it’s easy to tell ourselves that we’ve got it sorted and to avoid the hard questions. Become an expert on your own finances, what goes in and what goes out, where does it go. Get quotes and compare prices for insurance, bank accounts, mortgages and investments, become your own financial professional, and you’ll be able to talk about your own finances more objectively.

7. See a professional

If you’re struggling to either find a good time to talk to your partner or when you do talk you can’t agree, consider talking to a professional. They can help you navigate your differences and help you work out what’s important to you both.

Don’t wait for your partner to start the conversation. Get started using the tips above. The peace of mind of knowing your working towards the same financial goals and that you’re loved ones are protected should the worst will be worth the effort.

This information is for general use only and does not take into account your personal financial needs, objectives or circumstances.