5 Big Life Insurance Questions

Everyone likes it when their hard work is acknowledged, and we are no different at Pinnacle! We were delighted to be recognised by industry commentator Russel Hutchinson at Chatswood for our work on simplifying the brass tacks of life and living insurance in our new e-book “5 Big Life Insurance Questions”.

At Pinnacle, we aim to be the leading online life insurer in Aotearoa, and we strive to achieve that through our core values. One value is “Ease” - ensuring our customer’s experience is effortless, efficient, and effective. When we wrote the e-book, “ease” was top of mind. Life insurance can seem complicated, so we put lots of effort into ensuring all our communications and documents are written in plain English so everyone can understand it. This digital resource was no different.

What is in the e-book?

In the e-book, we take you through what life insurance is, along with our other living insurance products that fall under the life insurance umbrella. These products include Income Protection, Critical Illness, and Disability cover. We have a clear breakdown of each product and “a straightforward description of the common claims exclusions shown in the guide”, in the words of Hutchinson.

The e-book also covers the golden question – ‘How much cover do I need?’ This is different for everyone depending on their lifestyle. We offer a step-by-step guide on how you can settle on a number, with our award-winning online advice tool providing three levels of cover to choose from in just 10 minutes. Alternatively, we provide a simple framework to help get your head around what cover you need and how much it may cost.

The framework looks at 3 steps to help you decide:

1.Quick Calculation – In this step, we ask you to consider your income and debt to settle on one of our 3 levels, which include a basic, good and great cover.

2.Use our Quote Calculator – Once you have picked a level of cover suitable for you, insert that figure into our online quote calculator to get a simple breakdown of how much the cover will cost you.

3.Check – Double-check other financial factors in your life to ensure you are happy to pay the monthly premium and don’t go beyond your means.

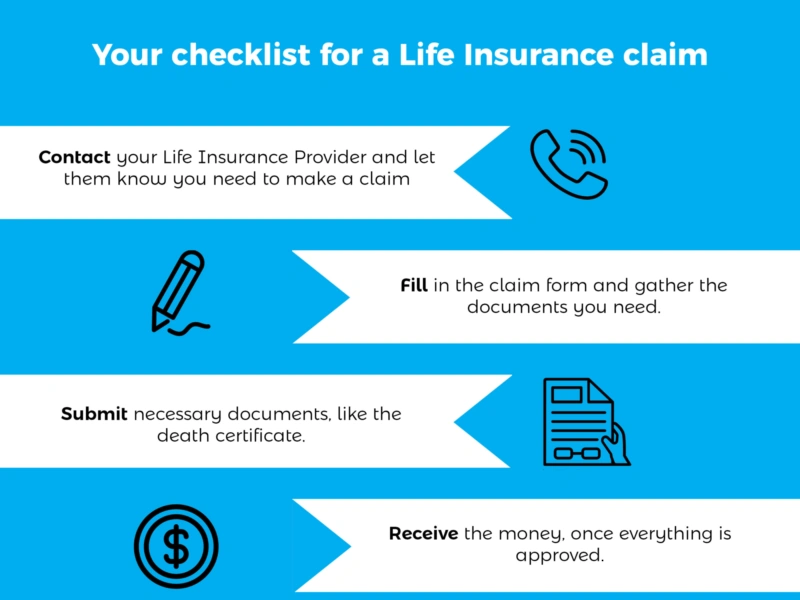

The e-book also includes details about applying online and getting a policy. We outline what happens when you need to claim, detailing how we can make it a stress-free process for you during a tough time in your life. To date, we have paid out 97.1% of claims!

Life insurance can feel complicated in terms of the actual application and the emotions that can arise in the process. But it’s an important part of any financial plan – particularly for parents and caregivers. At Pinnacle Life, we cut through any complexity to provide clear, simple, and comprehensive life insurance options, and this e-book offers just that. If you are interested in learning more about the “5 Big Life Insurance Questions” e-book, download your copy instantly today!