We’ve paid 98.9%* of the claims made on our policies. That’s because everything we do, from the moment you first take out a policy, is about making sure we can pay your claim when the time comes. And we like to do it as quickly as possible. Usually that means we can pay the claim within 7-10 working days of getting all the information we need. The total length of time depends on what information is needed and from who. You should also note that even though we may have paid the claim, the money may not be available to the family straight away.

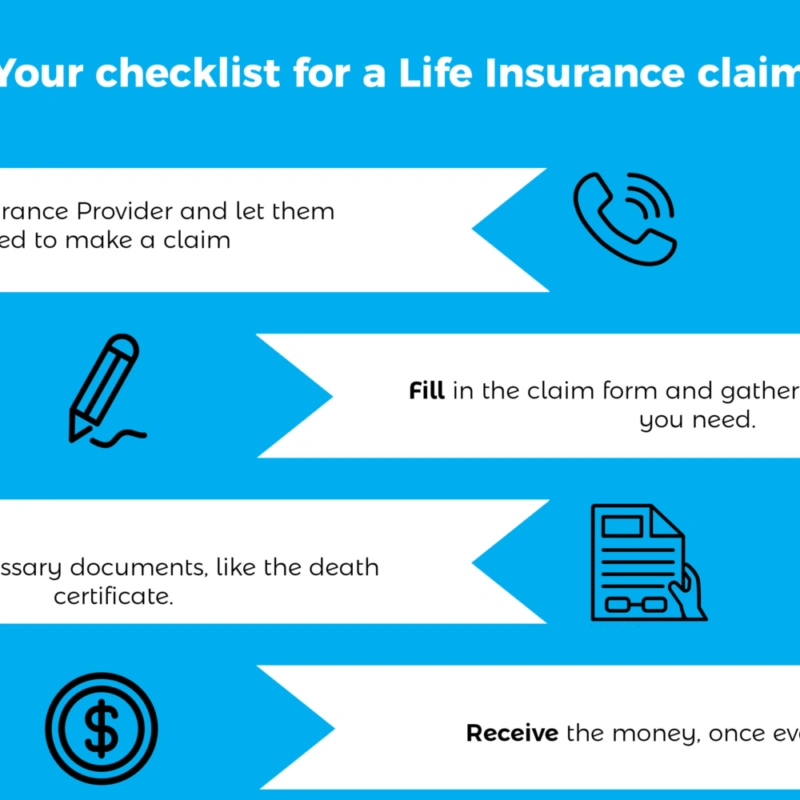

The process usually starts with a phone call to us, to let us know someone has died, or are ill and that you want to make a claim. We will send you a letter or email that includes a list of what we need. We try to keep this as simple as possible.

There’s some information we always need that includes:

proof of identity, like a birth certificate or passport, and a form signed by the policy owner or the executor or administrator of their estate.Then we also need:

|

For a ... |

We'll need ... |

How long does it take… |

|

a certified copy of the insured person’s death certificate, and a coroner’s report if one has been issued. |

A death certificate usually takes about 1-2 weeks and costs $33, they can be ordered online. A funeral director will often arrange this for you. A coroners report can also take a number of weeks. |

|

|

illness or disability claim (like a terminal illness, critical or serious illness claim) |

a written opinion from a medical specialist confirming that the insured person meets the criteria outlined in the policy document. We may then need further information, including information from the insured person’s doctor. |

This depends on the specialist and the illness or disability. Our experience indicates a few days to even a few weeks is realistic, then we need time to review the information as well. |

|

accidental death claim |

a certified copy of the insured person’s death certificate, and a copy of the coroner’s report |

A death certificate usually takes about 1-2 weeks and costs $33, they can be ordered online. A coroners report can also take a number of weeks. |

Once we have all the information, we will review it and assess the claim. Realistically you should expect that to take a couple of weeks. However that doesn’t always mean the money is instantly available to the family.

If the policy owner is also the life insured the money will go to their estate. If there’s a will with an administrator and clear instructions it’s generally straightforward and the proceeds should be available relatively quickly, but if you have to go through probate (getting approval to deal with the estate) that can take some time, 3 months on average. If there isn’t a will there can be other delays, as an administrator needs to be appointed by the high court and the funds then distributed according to a formula prescribed by the government. More information on that here.

To help your family (or the person carrying out the instructions of a will) get things sorted quickly there’s a few things you can do in advance that will make it easier for your family later.

When setting up your policy

- Make sure that you use your correct legal name, not a nickname, when you apply for your policy. It slows the process down if the death certificate is issued in your legal name, but you gave us your nickname or commonly used name when you took out the policy. If you regularly use two names then let us know when you take out your policy and we can get all the details sorted out up front. If you didn’t do this, get in touch and we can sort it out now.

- If you want the money paid to a particular person, rather than to your estate, fill in the change of ownership form that is attached to your policy document and send it back to us. (When you first take out your policy you are automatically the policy owner as well as life insured, so you need to change it if that’s not what you want). This will mean that your claim will be paid directly to that person, not to your estate.

- Give a copy of your policy to the person who either owns the policy, or the person who will look after your affairs if anything unexpected happens. That way, they know to contact us. You’d be surprised at how many calls we get from people who are ringing around insurance companies to see if a family member had a policy anywhere!

- Make sure your family also know who your GP is. We might need to gather medical information as part of the process, so we ask for your GP’s details upfront and record it on your policy document. If you change GPs make sure you’ve got a record of that so your family can help us find the details we need.

The most important thing you can do is make sure your family know you have a policy and that they call us as soon as they are able so that we can get things started. We know that this can be a terrible time for everyone, our hope is that by relieving the burden of financial stress your life insurance makes it a little easier for those you care about.

*as at 31 July 2019