Some of the most common questions we receive at Pinnacle Life revolve around smoking and the effect it has on your life insurance policy. Can you start smoking after taking out life insurance? Is vaping considered smoking when it comes to life insurance? Or what happens if you already have a policy but give up smoking? Here’s a quick guide to life insurance for smokers and vapers, and an overview of how we treat smoking as a provider.

How does smoking affect life insurance?

First and foremost, life insurance premiums are the sum of money you pay to an insurance company so that in the event of your death your loved ones will be paid a tax-free lump sum of cash, this is your sum insured. The premiums are designed to reflect your actual risk of dying compared to the average of the population. Premium rates are calculated using ‘actuarial’ tables based on actual mortality experience across tens, even hundreds of thousands of lives. Several factors of the insured are considered which include age, gender, health & medical history, occupation, family medical history, and lifestyle & habits. Smoking falls under lifestyle & habits.

According to the New Zealand Ministry of Health, around 5000 people die each year in New Zealand because of smoking. That’s 13 people a day. Some of the best-known health problems related to smoking are lung cancer and other conditions related to the lungs such as emphysema and bronchitis. Smokers also have two-to-three times the risk of having a sudden cardiac death than non-smokers. So, when you look at the facts, smoking increases your risk of death substantially, leading to an increase in the premium you will pay for life insurance. That’s not to say you can’t apply for cover, only that you will be paying for it at a higher rate.

What happens if you start smoking after you take out Life Insurance?

We do not encourage you to begin smoking after taking out life insurance, but we can understand that some people may pick it back up as a habit again later in life. When it comes to your existing policy with us, it will not affect it. When you apply for your life insurance policy with Pinnacle, we evaluate all factors at that time. However, you can only apply for a non-smoker policy if you have not smoked in the past 12 months. This also includes vapes and electronic cigarettes.

I vape (or smoke E-cigarettes) but I don't smoke cigarettes – am I still classified as a smoker?

If you have vaped or used E-cigarettes within the last 12 months, you are considered to be a smoker.

What happens if I have a smoker’s Life Insurance policy but stop smoking?

When you take out your policy, you are considered a smoker if you have smoked a cigarette or any other substance during the past 12 months, including a vape or electronic cigarette. Once you have been smoke-free and have not smoked tobacco or any other substance, including e-cigarettes and vaping, for 12-24 months, depending on your policy, you can request to change to cheaper non-smoker rates. Just fill in this declaration and return it to us.

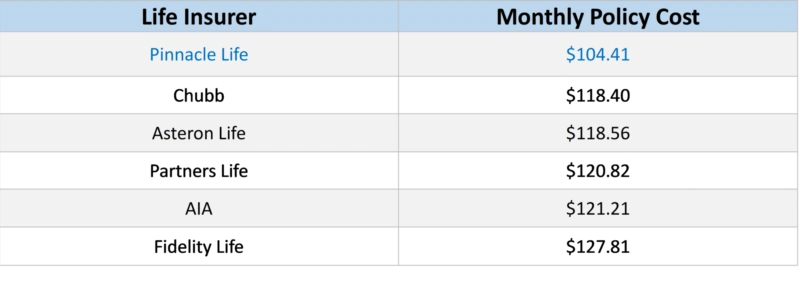

Pinnacle Life offers the most cost-effective Life Insurance for smokers.

If you do smoke and are looking to purchase life insurance, like anything you buy, it’s a good idea to shop around and see who is offering the price that suits you best. However, it is worth noting that we do offer the best price. We did our research, and found the premiums below for a 42-year-old male smoker looking for the cover of $500,000:

Why not start your Life insurance journey today and calculate your own quote or try our digital advice tool to help guide you in the right direction.