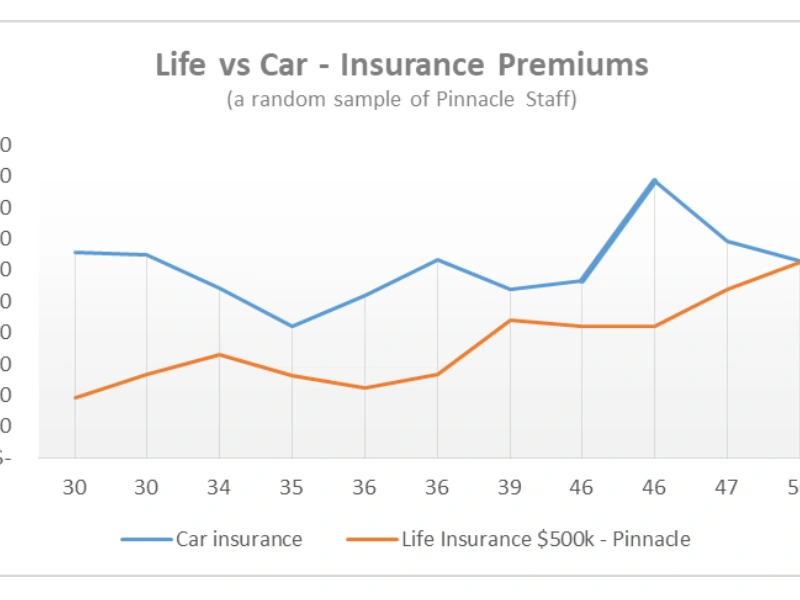

One of the biggest factors in determining the price of your life insurance premium is your age. Whilst generally we think that anytime is good for getting life cover, the price goes up as you get older.

The reason it creeps up every year is simple math, as you get older you are getting closer to your life expectancy and so, you are more expensive to insure. In other words, the risk of you getting ill or dying is increasing and therefore the cost to have life cover reflects that.

The rate at which your premium increases is an actuarial calculation that considers the chance of a person dying at a certain age. When you are younger there is a point where premiums decrease each year as the chance of dying drops. Unfortunately, as you get older the chance of dying increases and so your premiums then increase. The amount of the increase will vary from year to year.

If you are comparing life insurance companies don’t just look at what the premium is when you first take it out, also ask what your premiums are likely to be in the future. Then you know you’re not just getting a cheap price for the first year.

Your rate for a new policy is set at the time you take out a policy. A difference of 5 years, for example, can make a big difference to the price.

Wendy is 30. She is a non-smoker. For $500,000 of Pinnacle life cover, she will pay $19.19 a month. This includes a 10% discount for her first year and a healthy living discount of 10%.

If Wendy waited till she was 35 to take out $500,000 of cover, her starting premium would be $20.94 with the same discounts applied (assuming no rate changes).

Once you have your policy, your premiums will increase each year. Any discounts offered for the first 12 months also drop off in this time but you should still keep any healthy living discounts that were applied when you first took out your policy. As well as increasing because of your age our premiums will also increase automatically to keep your cover in line with inflation. You can turn this off at any time by contacting us.

If Wendy takes out her policy at 30 when she is 35 her premiums will be $23.13 a month.

If Wendy takes out her policy at 35, she can expect that after 5 years, when she is 40, her premiums will be $27.77.

We have calculators on our website that you can play around with to work out what suits you best.

You can:

- Get a quote

- Get an estimate of what your premiums will be in 5 years

- See what cover other people like you have taken out

- Compare our prices with competitors (part of getting a quote)

Life cover doesn’t expire, so as long as you keep paying you’ll be covered. If you cancel your policy you are no longer covered and you don’t get any premiums back, just like your car, contents and health insurance policies, it’s not an investment or a savings plan. What you do get is the peace of mind that your family will be looked after if anything was to happen to you.