Excellent question! At the end of the day, you are smart enough to decide what’s right for you. However, here are some things that you might want to consider.

Sorting out your funeral.

For many single people, sorting out your funeral will be left to your parents or siblings. There will be enough stress on the people you love having to deal with their loss, and a small amount of life insurance would avoid them having to deal with any additional financial stress at this time.

Especially if you are living in a different part of the country from your family, as there could be travel and accommodation costs to consider, as well as the funeral service itself.

Dealing with your estate / debts

If you have a mortgage, it is likely that it will take some time to sell the property and clear the mortgage. In the meantime, you don’t want your family to have to worry about the mortgage payments, or any other regular repayments you might have eg credit cards or hire purchase.

It is likely they will have to get some legal support around your estate, and so having some cash available to them for this will also reduce the stress on them.

All this takes time, and having some life insurance that is payable to the person responsible for handling your affairs to keep everything in order could be very useful.

Leaving a legacy

While you might be single, and have no dependents of your own, you may well have nieces or nephews that you may have intended to support financially around their education, travel, first home etc.

Having life insurance, supported by the right will etc, will enable you to do that for them, even if you can’t be there to celebrate those milestones with them.

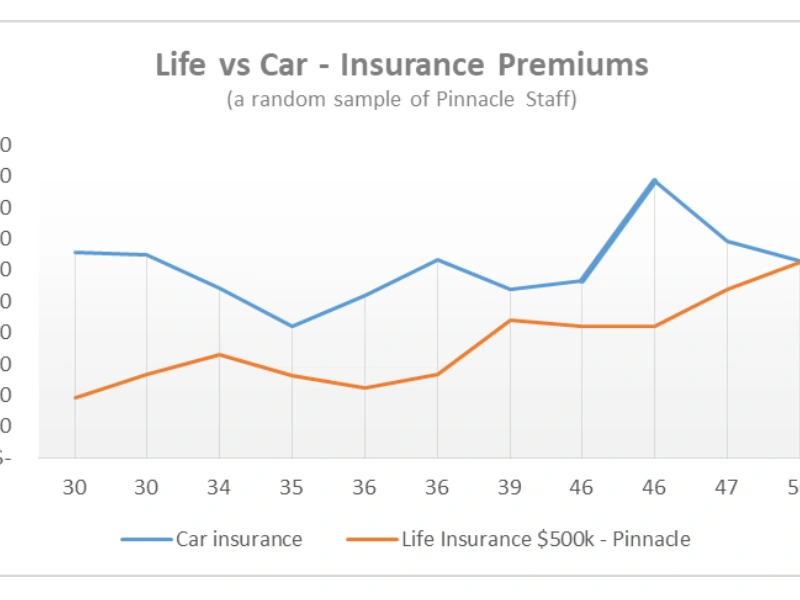

Getting life insurance now could be cheaper than waiting

Deciding when to take out life insurance is something a lot of people think about. If your health is good today, then now might be the time, as you never know what might happen tomorrow. So while you might end up paying for a few more years of premiums, this could end up being a long term saving – as if your health changes, taking out cover at a later date could be considerably more expensive. Even health conditions like getting a melanoma, or diabetes, can influence the levels of premiums you pay. But once you have life insurance, any changes to your health won’t affect your premiums on your existing policy.

So, it might make good financial sense to get life cover now rather than waiting.

In summary, although you might have thought that what happens after you are gone is not your problem, think about those you love and will leave behind. Taking out a life insurance policy can ease the strain of dealing with finances etc, as well as the loss of a loved one.

At Pinnacle Life, you can apply online, and in less than ten minutes you could have this sorted out – from as little as $16 per month (that’s about $4 per week).