Wahoo you’ve bought your first home! How exciting, you’ve got BBQ’s planned, paint colours to choose and lawns to start mowing.

We kiwis love our homes… most nights on TV you can find a program on home design, renovating or gardening. It’s not just the ‘American dream’ it’s the ‘Kiwi dream’ too, and these days it seems to come with a hefty mortgage.

If you own a car you’re probably familiar with Car Insurance and if you’ve been renting you’re probably familiar with Contents Insurance. It’s a fairly simple step to now add House Insurance to cover the costs if your home is damaged or destroyed. In fact your mortgage lender may have required you to have your house insurance sorted before you took possession.

They may also have required you to have taken out Mortgage or Life Insurance as well. These are two different products so make sure you’ve got what you need and that you understand what you have. The key difference is who the money is paid out to.

Mortgage Insurance: Mortgage Insurance simply pays off your mortgage if you die, or earlier if you’re diagnosed with a terminal illness. The tax-free lump sum will get paid directly to your nominated mortgage lending institution. This will keep a roof over the heads of the people you leave behind.

Life Insurance: Life Insurance can pay your mortgage AND the bills if you die or earlier if you’re diagnosed with a terminal illness. The lump sum is paid to the owner of the policy (tax-free) and can be used not just to pay off the mortgage but for anything they choose. For example it may simply pay off the mortgage, buy groceries and pay the bills and basically supplement the income you have lost while you take time to grieve, or it can be put aside to invest in your children’s education or whatever else you choose.

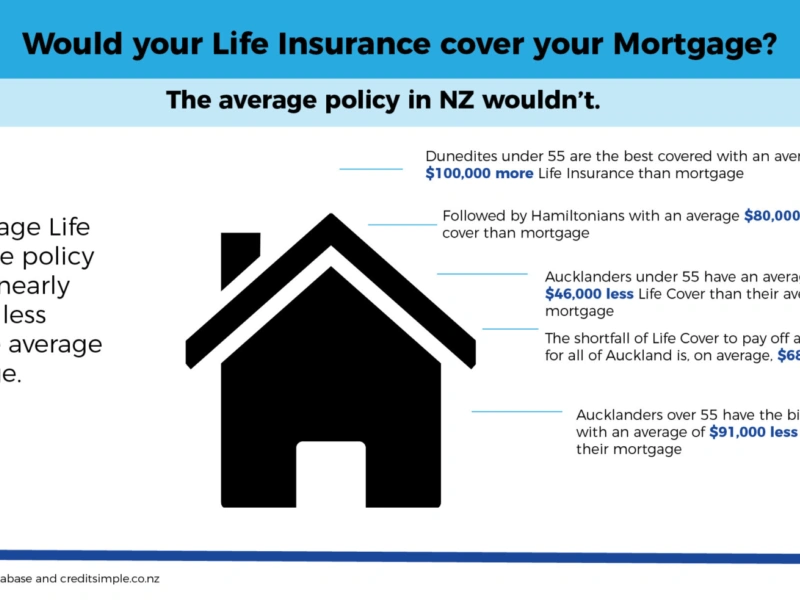

Scarily, Kiwis are typically under-insured or not insured at all. A recent survey from TradeMe confirmed that little has changed since 2013 when the survey was first run, with only 51% of respondents saying they have Life Insurance.

It seems we just don’t like to think about the worst-case scenarios. At Pinnacle Life we urge you to think this through. Some questions you might start off thinking about are:

If anything happens to one of us:

- could the other person afford to pay the mortgage?

- could they also pay bills and groceries?

- if you have children, could you afford child care?

- how can we make it as stress-free for the other person as possible?

It takes less than a minute to get a quote and less than 10 minutes to be covered with Pinnacle Life. Protect your mortgage AND your family today.