If you've managed to buy a home, congratulations! That’s no easy feat. Now it's time to tackle that mortgage.

Buying a home has long been on Kiwis' must-do dream list. In recent years, however, prohibitive house prices have pushed the dream out of reach for many, and rising living costs are making the dream seem even more impossible. A recent study by OneChoice indicated that 90% of first-home buyers feel locked out of the property market. If you've bought a home, it's probably been a long hard effort. Now the challenge is paying off the mortgage.

The benefits of paying your mortgage off faster:

- Paying off your mortgage as fast as you can has several benefits that can positively impact your financial situation, including saving money on interest payments and achieving financial freedom sooner.

- Interest savings: By paying off your mortgage faster, you reduce the total interest you pay over the life of your loan. This can save you thousands of dollars, depending on the size and term of your mortgage.

- Financial freedom: Paying off your mortgage early frees up a substantial monthly expense. Once you've paid off your mortgage, you no longer need to put a portion of your income towards the mortgage payment, giving you more financial flexibility and the ability to put those funds towards other financial goals, such as retirement savings or other investments.

- Homeownership security: Owning your home outright provides a sense of security and peace of mind. You no longer have the risk of losing your home if you run into financial difficulty, which might happen if you have a significant health issue and can no longer work or lose your job for any reason. Of course, these are also good reasons to have life insurance or income protection!

- Investment opportunities: Once you no longer have a mortgage payment, you can redirect what you were paying towards other investment opportunities. Those opportunities could be anything from contributing more to retirement accounts, investing in shares, or starting a business. Being mortgage-free allows you to put your money towards other assets that have the potential to grow and generate wealth – protecting your future even further.

- Psychological well-being: perhaps the best thing about paying off your mortgage faster is a sense of accomplishment and relief. Being debt-free and owning your home outright can reduce stress and provide greater financial stability, allowing you to focus on other aspects of your life and pursue other goals.

Ideas for paying off your mortgage faster:

- Pay more than the minimum: When you take out a mortgage, the term you select will determine your minimum payment. At the moment, with high-interest rates, that may be all you can afford. But any amount you can pay above that minimum will go straight off the principal and mean your loan gets paid back faster.

- Increase your payments. Even a seemingly small increase, like $10 or $20, can make a big difference over time. Because many mortgages are for 30-year terms, little payments can add up over time and make a real difference to your mortgage overall. Any time you get a pay rise, try to put most of it towards increasing your payments.

- Make fortnightly instead of monthly payments: Instead of making monthly mortgage payments, switch to fortnightly. Doing this means you'll make 26 half payments in a year (equivalent to 13 monthly payments) or, in other words, two extra payments. This can significantly reduce the overall term of your mortgage, and importantly when interest rates are higher can make an even bigger difference.

- Make lump-sum payments: Whenever you have extra cash available, such as a tax refund, bonus, or inheritance, make a lump-sum payment towards your mortgage. This payment will directly reduce the principal balance, helping you repay your mortgage faster.

- Round up your payments: This is a great but straightforward tip for paying a little extra - round up your mortgage payments to the nearest ten, hundred or even thousand dollars. For example, if your monthly payment is $1,542, consider paying $1,600 instead. The extra amount will go towards the principal and help you pay off your mortgage quicker.

- Refinance - Keep an eye on interest rates in the market. When you first get a mortgage, it's normal to spend a lot of time researching the best rates and taking advantage of any deals. Once your mortgage is locked in, it's easy to think you're stuck with that bank; however, that's not the case. When your mortgage comes up for renewal, shop around and see if you can secure a more competitive rate. Like paying a little bit extra, a difference of even 0.1% in your rate can make a big difference.

Making sure payments are covered in case of an emergency

Servicing a mortgage is no piece of cake, and should something go wrong; it certainly doesn't make things easier. Consider how you will continue to pay your mortgage if something goes wrong.

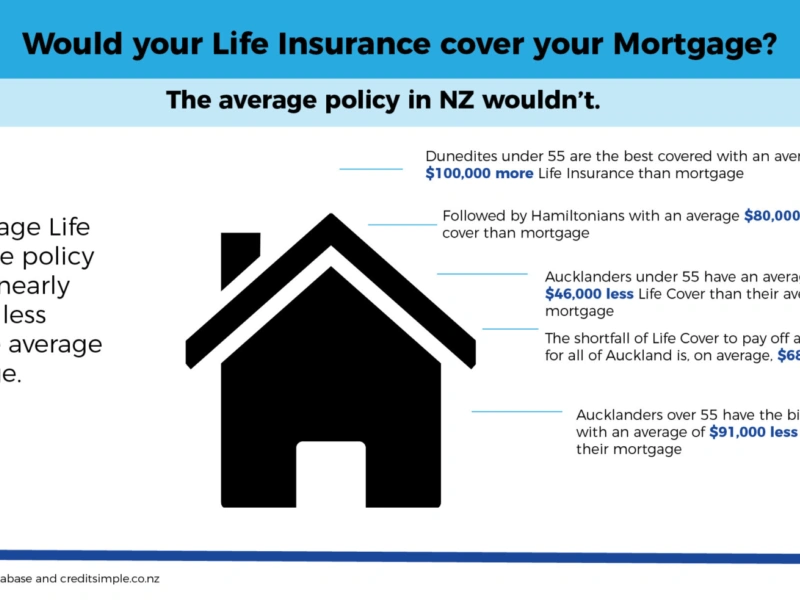

One option is a life insurance policy. Life insurance policies can provide a lump sum payment if you were to pass away and can also provide the ability to add optional cover for serious illnesses and permanent disabilities. In this way, you or your family could receive a payout that can help to cover mortgage repayments should the worst occur.

Income protection pays a monthly amount if you are unable to work due to illness or injury. Itc an cover you even when ACC doesn’t.

If you're looking at your finances, it's important to consider your overall financial situation and the potential benefits of paying off your mortgage faster against other financial priorities, such as paying the bills, saving for emergencies or investing in retirement accounts.

Always check with your mortgage lender regarding any prepayment penalties or specific instructions for making extra payments. Implementing these tips and disciplined financial management can help you pay down your mortgage faster and achieve your goal of owning your home outright.

This blog only provides you with general information and doesn’t consider your personal situation or objectives. If you’d like advice about your personal situation, contact our customer service team at ask@pinnaclelife.co.nz or on 0800 22 22 23, or try our advice tool for a personal recommendation. This blog is intended to provide you with general information only and doesn’t take into account your personal situation or objectives. If you’d like advice about your personal situation contact our customer service team at ask@pinnaclelife.co.nz or on 0800 22 22 23, or try our advice tool for a personal recommendation.