Critical Conditions Cover

Adding Critical Conditions Cover to your Life Insurance policy helps to ease the burden on your family at a difficult time.

Having Critical Conditions Cover means that if you suffer from one of the 38 conditions specified in your policy, you will receive a lump sum payment to use however you need.

Critical Conditions can only be purchased alongside Life Insurance.

Providing a financial safety net when you need it most

As an optional add-on to your Life Insurance policy, Critical Conditions Cover provides a tax-free lump sum payout if you are diagnosed with a covered critical illness or condition, helping you manage the financial impact while you're still alive.

This ‘early payment’ benefit gets deducted from your Life Cover and can help cover medical expenses, replace lost income, or simply offer peace of mind during a challenging time.

Pinnacle’s Critical Conditions Cover

Policy summary

Pinnacle Life's Critical Condition Cover is an optional add-on to your Life Insurance. It provides a tax-free lump sum payout if you're diagnosed with a covered critical condition or illness. This financial support can be used for medical expenses, to replace income, or simply for peace of mind during a challenging time.

Flexible cover where you have the freedom to choose the level of cover that best suits your needs and budget, giving you control over your financial security.

Change your mind within 30 days of starting your Pinnacle Life Critical Conditions policy? We’ll refund your money, no questions asked.

What’s covered?

If you add Critical Conditions Cover to your policy, we'll pay the policy owner a tax-free lump sum if you're diagnosed with one of the 38 covered illnesses or conditions.

While cancer is the most common reason we pay out for claims, our comprehensive policy also covers heart attacks, strokes, advanced dementia (incl. Alzheimer's disease) and many other conditions.

What’s not covered?

Illnesses or conditions not specified in our covered definitions

Self-inflicted injuries.

Depending on your health and lifestyle other exclusions may be added to your policy.

*More details are in the application process and your policy document.

How does Critical Conditions cover work with my Life Insurance?

If you claim on your Critical Conditions cover, the tax-free lump sum payout will reduce the amount of your Life Insurance cover.

Your privacy

Your information is important to us. We will never share your information.

For more details, view our Privacy Policy.

When does your cover end?

Critical Conditions cover remains active as long as you continue to pay your premiums.

The last day of the month in which the insured person turns 70.

When the full amount of the claim is paid.

You may also choose to cancel your policy at any time.

When you need to claim

- You will get a cash lump-sum payment, depending on the amount of cover you've selected of up to $625,000.

- Your Life Insurance will reduce by the amount of the lump-sum payment. Critical Conditions Cover is an 'early payment benefit', sometimes called 'accelerated' cover.

- Your claim will be paid in New Zealand Dollars anywhere in the world, to the person who owns the policy.

- Your policy will be reinsured by Hannover Life Re, one of the largest reinsurers of life insurance in the world.

Current Pinnacle Customers

If your policy talks about 'Critical Illness’ or 'Serious Illness', not ‘Critical Conditions', you have a policy that is no longer available. A Critical Illness policy covers 24 conditions, click here to see what you're covered for. A Serious Illness policy covers 4 conditions, click here to see what you're covered for.

Additional insurance products by Pinnacle Life

Life Insurance

Life insurance provides for those you leave behind. It helps them pay the mortgage, invest in education, put food on the table, and pay the bills.

Income Protection

Income Protection pays you a monthly amount if you are unable to work due to illness or injury - so you can carry on with your life even though you're not earning.

Disability Cover

Having Total and Permanent Disability cover means that if you become permanently unable to work, or meet our Total and Permanent Disability definitions due to accident or illness, you will receive a lump sum payment to use however you need.

Our customers say the loveliest things

View all reviewsEasy online application. Price for cover is affordable.

Easy to deal with, reasonable and affordable premiums.

Great premiums for a fair coverage. Very straight forward process and very easy to understand.

When I raised the issue, your service was very prompt. The response to my enquiry was excellent.

Answered all questions in a timely manner.

Get Covered in 3 Easy Steps

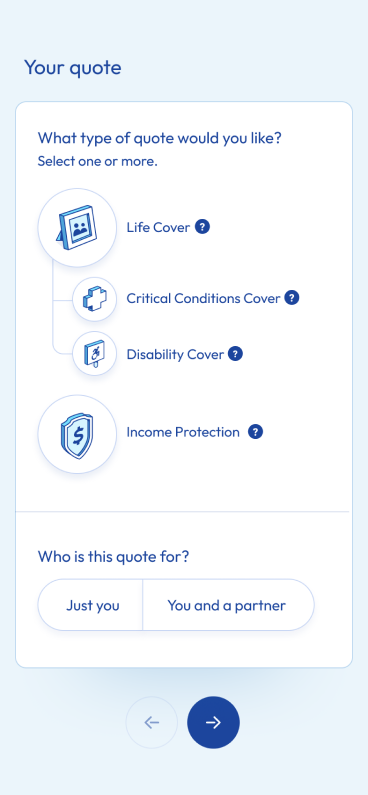

Start with an online Pinnacle Life Insurance quote – at the beginning of this process, you have the option to add Critical Conditions Cover.

-

1

Get a quote

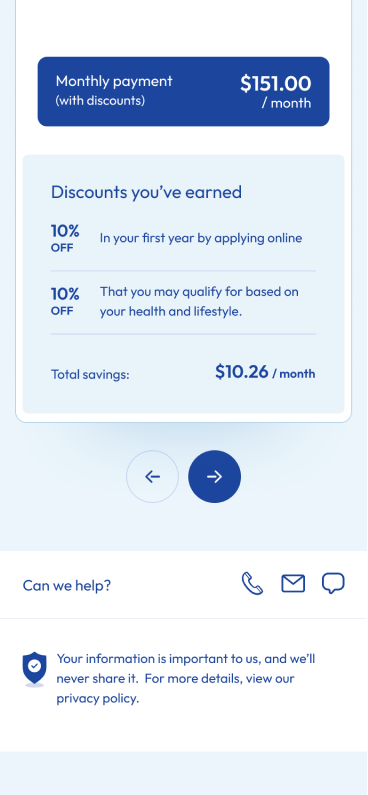

Select your products and add a few details to get started (you can edit products later). Adjust your lump sum payout amount and monthly premiums to find the right balance for you.

-

2

Apply online

We’ll ask you some health and lifestyle questions; depending on your answers, you could be covered in just 10 minutes.

-

3

Get covered

We’ll email you your policy. Your cover starts immediately, provided we receive your first payment within 14 days.

Need help working out how much cover is right?

What type of cover should you choose? How much cover should you get? How much will it cost? For many people, this is where buying life insurance gets complicated and overwhelming. We've got the tools to help.

Frequently asked questions

What’s the difference between Life Insurance and Critical Conditions cover?

What’s the difference between Life Insurance and Critical Conditions cover?

Life insurance pays your loved ones a one-time payment if you die or are diagnosed with a terminal illness and have less than 12 months to live. You can enhance your Life Insurance with Critical Conditions cover, an optional add-on that provides a tax-free lump sum payment if you're diagnosed with a covered serious illness or condition, helping you manage the financial impact while you're still alive.

What is the difference between Critical Conditions and Total & Permanent Disability (TPD) cover?

What is the difference between Critical Conditions and Total & Permanent Disability (TPD) cover?

Critical Conditions Cover and Total and Permanent Disability (TPD) Cover both offer a tax-free lump sum payout while you're still alive, but for different reasons:

- Critical Conditions cover pays out if you're diagnosed with a specific serious illness or condition covered by your policy, regardless of whether you can continue working.

- Disability Cover (TPD) pays out if you become totally and permanently disabled and are unable to ever work again due to illness or injury.

What illnesses does Critical Conditions Insurance cover?

What illnesses does Critical Conditions Insurance cover?

Pinnacle Critical Conditions Cover includes 38 conditions, with cancer, heart attack, and stroke being the most common reasons for claims. Click here for a complete list of covered conditions.

How much does Critical Conditions Insurance cost?

How much does Critical Conditions Insurance cost?

Monthly premiums are based on the cover you want. How much Critical Conditions cover costs depends on things like your age, gender, whether you smoke and other health and lifestyle factors. Get a quote in just 30 seconds to find out what it will cost you.

Do I need Critical Conditions Cover if I have health insurance?

Do I need Critical Conditions Cover if I have health insurance?

Health insurance covers medical costs like surgeries and hospital stays, while Critical Conditions cover provides a tax-free lump sum payment if you're diagnosed with one of the 38 conditions or illnesses. This tax-free lump sum can be used how you choose such as helping cover additional medical expenses, replacing lost income, or paying for everyday living costs.

Can I get Critical Conditions Cover if I am self-employed?

Can I get Critical Conditions Cover if I am self-employed?

Yes, you can get Critical Conditions cover if you're self-employed. Try our simple online application.

How do I apply for Critical Conditions Cover with Pinnacle?

How do I apply for Critical Conditions Cover with Pinnacle?

Start with an online Pinnacle Life Insurance quote – you can add Critical Conditions Cover at the start of this process. Get a personalised quote in 30 seconds by entering some basic details - your gender, age, and smoking status. When you're happy with your cover and monthly premium, answer a few health questions, set up your payment, and you're covered!

Our team is here to support you every step of the way, so contact us if you need help at any point.

Choose Pinnacle Life for proven, award-winning life insurance that has been safeguarding Kiwis for over two decades.

Experience the peace of mind that comes with affordable, simple and secure life insurance cover.