Disability Cover

Protect Your Future, Even When Life Changes

Having Total and Permanent Disability cover means that if you become permanently unable to work, or meet our Total and Permanent Disability definitions due to accident or illness, you will receive a lump sum payment to use however you need.

Total and Permanent Disability cover can only be purchased alongside Life Insurance.

Total and Permanent Disability Cover offers a financial safety net when you need it most.

Serious illnesses or injuries can sometimes leave you with lasting disabilities that prevent you from working. If this happens, Pinnacle Life's Total and Permanent Disability Cover, an optional add-on to your Life Insurance, can help.

It provides a tax-free lump sum payment to cover expenses like medical bills, home modifications, or daily living costs, giving you financial security during a difficult time.

This payment comes from your existing Life Insurance cover, so it's like an early payout that helps you when you need it most.

Pinnacle’s Permanent Disability Cover

Disability Cover is also referred to in NZ as:

Total and Permanent Disability Cover (TPDC or TDC)

Permanent Disability Insurance

Total Disability Insurance

Long-Term Disability Insurance

Policy summary

Pinnacle Life's Total and Permanent Disability Cover is an optional add-on to your life insurance. It provides a tax-free lump sum if you become permanently disabled and unable to work due to illness or injury. This financial support can be used for medical costs, home adaptations, daily expenses, or any other needs during this difficult period, providing essential financial relief.

Flexible cover where you have the freedom to choose the level of cover that best suits your needs and budget, giving you control over your financial security.

Change your mind within 30 days of starting your Pinnacle Life policy? We’ll refund your money, no questions asked.

What's covered?

A tax-free lump sum if you are permanently unable to work due to illness, accident, or injury.

Covers disabilities that meet our Total and Permanent Disability Definitions.

What's not covered?

Self-inflicted injuries.

Disabilities caused by illegal activities and certain hazardous occupations.

Depending on your health and lifestyle other exclusions may be added to your policy.

*More details are in the application process and your policy document.

How does disability cover work with my life insurance?

If you claim on your Total and Permanent Disability cover, the tax-free lump sum payout will reduce the amount of your Life Insurance cover.

Your privacy

Your information is important to us. We will never share your information.

For more details, please see our Privacy Policy.

When does your cover end?

Total and Permanent Disability Cover remains active as long as you continue to pay your premiums.

The last day of the month in which the insured person turns 65.

When the full amount of the claim is paid.

You may also choose to cancel your policy at any time.

When you need to claim

- You will get a cash lump-sum payment, depending on the amount of cover you've selected of up to $1 million.

- Your Life Insurance will reduce by the amount of the lump-sum payment. Total and Permanent Disability Cover is an 'early payment benefit', sometimes called 'accelerated' cover.

- Your claim will be paid in New Zealand Dollars anywhere in the world, to the person who owns the policy.

- Your policy will be reinsured by Hannover Life Re, one of the largest reinsurers of life insurance in the world.

Additional insurance products by Pinnacle Life

Life Insurance

Life insurance provides for those you leave behind. It helps them pay the mortgage, invest in education, put food on the table, and pay the bills.

Income Protection

Income Protection pays you a monthly amount if you are unable to work due to illness or injury - so you can carry on with your life even though you're not earning.

Critical Conditions Cover

Having Critical Conditions Cover means that if you suffer from one of the 38 conditions specified in your policy, you will receive a lump sum payment to use however you need.

Our customers say the loveliest things

View all reviewsI'm happy with the cover and the level of protection it leaves my family in the future in my untimely demise.

Easy to deal with! 10/10 experience.

Lovely staff very informative and helpful. Easy to use website to quote and book life insurance.

People on hand if have questions. Very helpful, someone called and emailed as I hadn’t finished buying my cover in case I had questions.

Good service given.

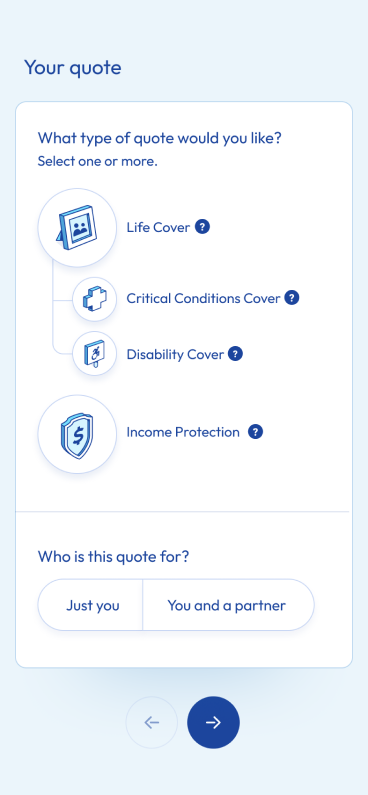

Get covered in 3 easy steps

-

1

Get a quote

Select your products and add a few details to get started (you can edit products later). Adjust your lump sum payout amount and monthly premiums to find the right balance for you.

-

2

Apply online

We’ll ask you some health and lifestyle questions; depending on your answers, you could be covered in just 10 minutes.

-

3

Get covered

We’ll email you your policy. Your cover starts immediately, provided we receive your first payment within 14 days.

Need help working out how much cover is right?

What type of cover should you choose? How much cover should you get? How much will it cost? For many people, this is where buying life insurance gets complicated and overwhelming. We've got the tools to help.

Frequently asked questions

What’s the difference between Life Insurance and Disability Cover?

What’s the difference between Life Insurance and Disability Cover?

Life insurance gives your loved ones a one-time payment if you die or are diagnosed with a terminal illness and have less than 12 months to live.

Disability Cover is an optional add-on to your Life Insurance. It will provide a tax-free lump sum payment if you become permanently disabled and are unable to work. This financial support can be used any way you choose, to help you manage the costs associated with your disability.

How much does Disability Cover cost?

How much does Disability Cover cost?

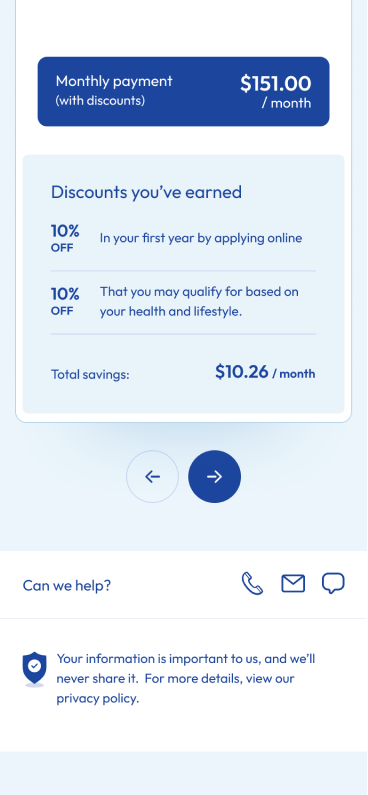

Monthly premiums are based on the cover you want. How much Disability Cover costs depends on things like your age, gender, whether you smoke and other health and lifestyle factors. Get a quote in just 30 seconds to determine what it might cost you.

Do I need Disability Cover if I have ACC?

Do I need Disability Cover if I have ACC?

ACC covers accidents but not illnesses or medical conditions that result in you being permanently disabled and unable to work. Disability Cover would protect you in these situations. This tax-free lump sum can help manage the costs associated with your disability, giving you peace of mind during a difficult time.

Can I get Disability Cover if I am self-employed?

Can I get Disability Cover if I am self-employed?

Yes, you can get Disability Cover if you're self-employed.

How do I choose the right Disability policy?

How do I choose the right Disability policy?

At Pinnacle, choosing the right Disability Cover policy is simple. We offer one comprehensive policy that you can customise to your needs. You can select the level of cover that suits your needs and budget, and our team is here to support you in this process.

How do I apply for Disability Cover with Pinnacle?

How do I apply for Disability Cover with Pinnacle?

Start with an online Pinnacle Life Insurance quote. At the beginning of this process, you'll have the option to add Disability cover. Enter your gender, age, and smoking status to get a personalised quote in 30 seconds. When you're happy with your cover and monthly premium, answer a few health questions, set up your payment, and you're covered!

Choose Pinnacle Life for proven, award-winning life insurance that has been safeguarding Kiwis for over two decades.

Experience the peace of mind that comes with affordable, simple and secure life insurance cover.