We all want to help our friends in times of tragedy. Sometimes we are also drawn to help people we have never met. Everyday day we read about misfortunes in the news; families who have lost a father or mother, children suffering from illness, it’s heart-breaking and can be overwhelming. Crowdfunding pages are full of people both with need and those wanting to help financially. The sad news is, while donations help they will often never raise enough to financially sustain those left behind.

Obviously, at Pinnacle Life we believe in having insurance. That’s because we have seen what a difference it can make to people in a time of grief, and because we know that to claim on a life insurance policy is a lot less stressful than to raise the same amount online.

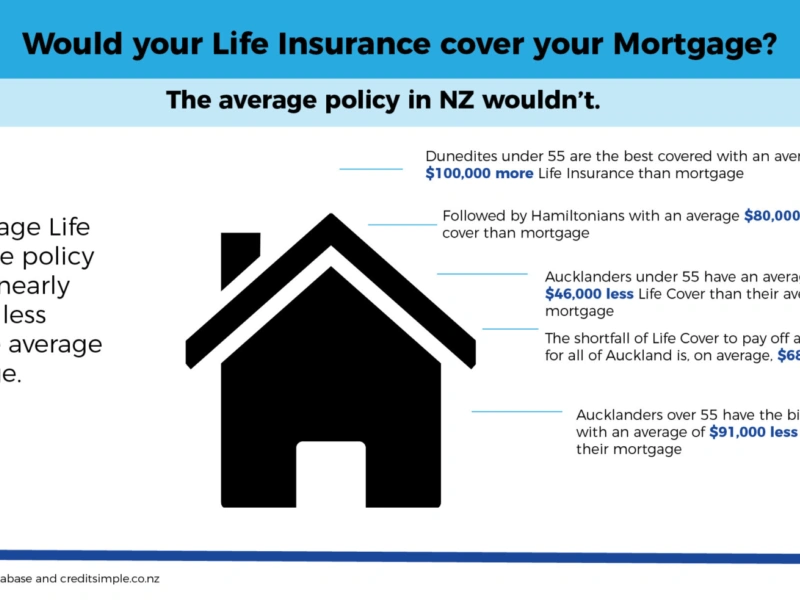

New Zealanders are typically underinsured and we expect the NZ millennial generation to be even more so than previous generations. Articles suggest that millennials use crowdfunding campaigns regularly. This all points in a direction that we feel concerned about.

There are a number of factors contributing to this situation. Getting life insurance was once a part of the “adult checklist” that included getting a job, getting married, having a baby, and buying a house. With rising house prices, fewer people choosing to get married, and people having babies later, the traditional route to ‘adulthood’ is now anything but linear, and somehow during this change getting life insurance has dropped off the list.

Millennials are sometimes described as ‘Generation Me’ because there seems to be more of an emphasis on the self than in previous generations. This often results in viewing other sources such as parents or crowdfunding as backup plans, instead of planning ahead with their personal finances, including preparing for when catastrophe strikes.

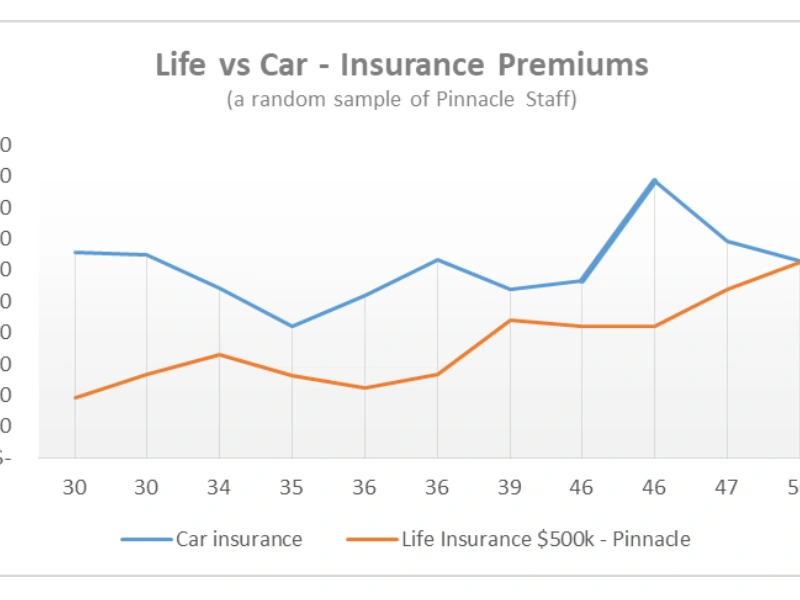

One reason cited for underinsurance in an American article was that millennials believe they cannot afford life insurance because they don’t really know how much it costs! They also don’t understand it. Pinnacle Life has a particularly easy quote and comparison calculator and pages to help you get started but there are others out there, including independent sites such as, sorted, life-info, the shape of money.

Finally, we think, getting insurance sorted has moved off the must-do list and onto the long-term to-do list. Life insurance belongs on the priority list. The good news once it’s done you don’t have to think about it again!

We can tackle these mindsets by encouraging our friends and family to plan ahead and take charge of their financial future instead of turning to options such as trying to raise money in a time of grief and stress. Check out the links in the article, set a deadline, get a quote, and get it sorted. Easy.