So you’ve Marie Kondo’d your wardrobe and your plastics drawer, but have you thought about your finances? Spring is in the air but it’s still pretty wet out there, so while it’s too miserable to get busy outside it’s the perfect time to shake the cobwebs from your money situation.

1. Commit yourself to tidying up.

Firstly, if you procrastinate you’ll never do it! So set a time to spend with yourself sorting out your finances. You might want to set aside a few smaller blocks rather than 1 big one. Internet banking gives you 24-7 access to your cash flow so all you need is the internet and maybe a pen and paper to note things down as you go. The key is to just get started.

2. Imagine your ideal lifestyle.

Marie Kondo says “Imagining your ideal life serves as your motivation and clarifies your goals before you tidy.” This absolutely serves your financial life as well as your belongings. Think about your ideal financial situation, how do you want to live? Who depends on you? Do you want to buy a house? Be mortgage free? Retire in the next ten years? Talk to your family about their financial goals too and make sure you’re all on the same page.

3. Finish discarding first. Before getting rid of items, sincerely thank each item for serving its purpose.

Translated into financial speak… this steps means working through what you’re spending your money on today, and keeping focused on those that give you joy, that is, the ones that will help you achieve your long term goals. You can either review your transactions online or just take it a day at a time, working out what’s important to you and what’s not. For example you might be in the habit of buying your lunch every day, realising that would pay for an overseas holiday might be the motivation you need to start bringing your lunch from home.

4. Tidy by category, not location.

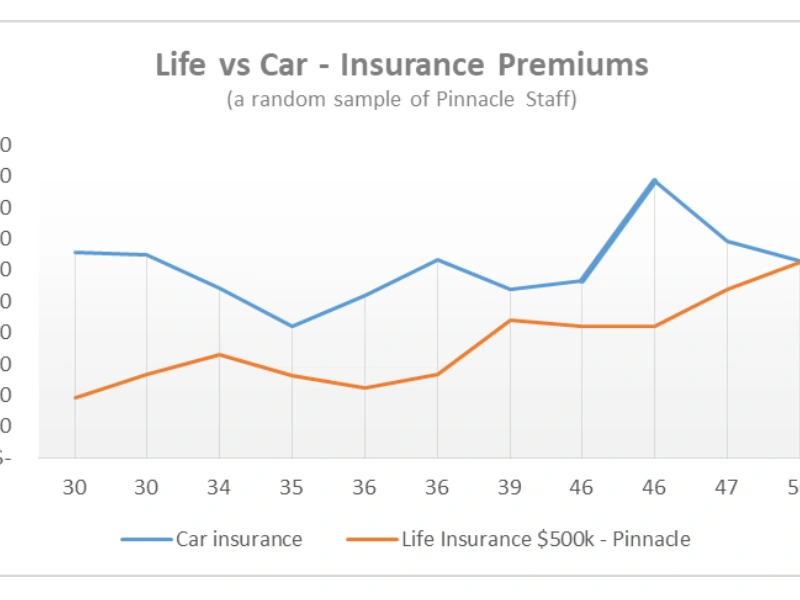

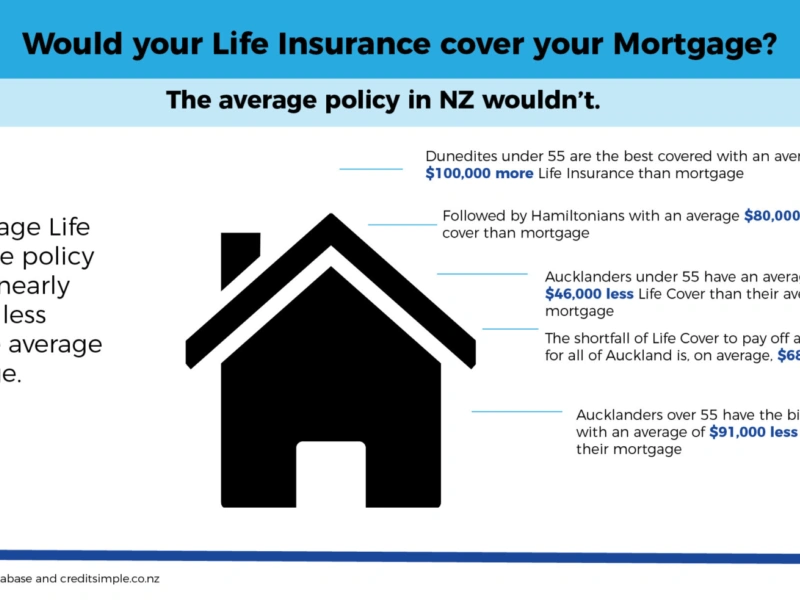

Once you’ve worked out what expenses you can discard (that is, stop) from your daily spending you can start tidying up your finances. Start by categorizing your financial goals. There are a number of ways to do this, one way is to think about your short and long term goals, for example pay the credit card off in full each month versus retiring at 55. You can also categorise your spending by type, for example paying bills, savings and discretionary spend. As well as these groups make sure you also consider insurances (especially yourlife insurance of course!) investments, and wills.

Once you’ve categorised your spend work through the same process again. For example for insurance think about what’s important to you at a high level, your family, your health, your car, your house etc. and make sure you’ve got it protected. For investments think about the timeframe you’ve got and your risk appetite and choose investments accordingly.

This can take a while! So break it down into chunks if it gets overwhelming. For example one week look at your bills, the next insurances and so on.

5. Ask yourself if it sparks joy.

The success of Marie Kondo’s decluttering method is largely because she focuses on mindfully choosing the things that spark joy, as opposed to what needs to be discarded. Keep this in mind as you sort through your finances. Make sure you have your long term dreams in mind when you choose how you spend your money. If buying a coffee every day or being able to watch what you want on Netflix genuinely gives you joy, you should choose to spend on these things. Just be sure you’re not sacrificing your future for a moment today.

If this feels totally overwhelming there are lots of websites and resources out there that have helpful tools. Try www.sorted.org.nz for a good starting point. Or if you’re focused on sorting your life insurance we can help you work out what cover you need. By the time you've done all of that the sun will be shining and you can head outside