Life Insurance and Your Mortgage: Why It Matters

When you get a mortgage, you often need to meet several conditions for the bank to approve your loan. These might include proving you have home insurance, proof of boarder income, and more. But what about life insurance? Banks used to sell life insurance when you took out your home loan, but most banks have moved away from this in recent years, so should you still consider getting life cover?

The Basics of Life Insurance

Life insurance is designed to financially support your loved ones if you were to pass away or become critically ill. It pays a lump sum to your policy beneficiary to help cover expenses. This could include:

- Short-term expenses like paying for the funeral or travel for family members.

- Medium-term expenses like covering the loss of income or the cost of a person's time and effort in raising children, managing household tasks, etc.

- or longer-term expenses, such as covering the cost of children's education or paying off the mortgage.

What Does This Mean for Your Mortgage?

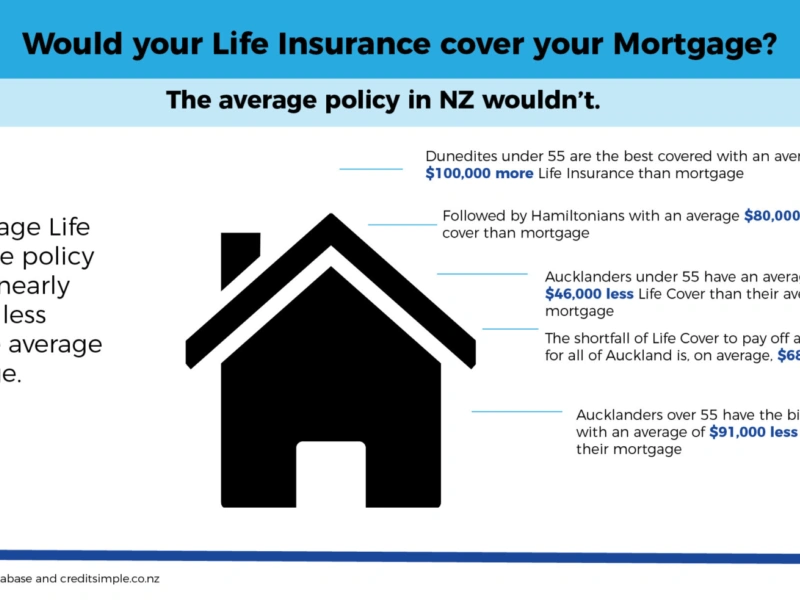

A mortgage is a large debt you take on when buying property. As discussed in our previous blog, this debt can be passed on to the person you've co-signed the loan with or your estate if you pass away. This means someone must make or increase their payments to cover your portion. This is where life insurance comes in. Your life cover can provide a lump sum to cover part or all of the mortgage, reducing the debt burden.

Is Life Insurance Right for You?

The need for life insurance is not a one-size-fits-all situation. It's a decision that's influenced by your unique financial and personal circumstances. The significance and reasons for having life insurance will evolve over time. Factors such as the size of your mortgage, your relationship status, parental responsibilities, and your age all come into play. Ultimately, the decision to obtain life insurance is yours. (If you need assistance in determining the right amount for you, our advice tool is at your service.)

When life insurance and mortgages are discussed together, it’s about the importance of protecting your loved ones from the debt that will be passed on to them if you pass away. Banks may add this as a condition to your home loan to ensure there is protection in place if the worst were to happen, even if they don’t offer it directly.

If you want to discuss how your mortgage and situation fit with life insurance, call 0800 22 22 23 or email getcovered@pinnaclelife.co.nz. We can help you with a no-obligation conversation.