There are a lot of things that need organising to make sure that your family is well protected if the unexpected did happen, and you were no longer around.

While this isn’t an exhaustive list, we understand how complex this can be and so at Pinnacle Life, we’ve developed some resources to help, to make sure your family is left financially secure.

Life Insurance

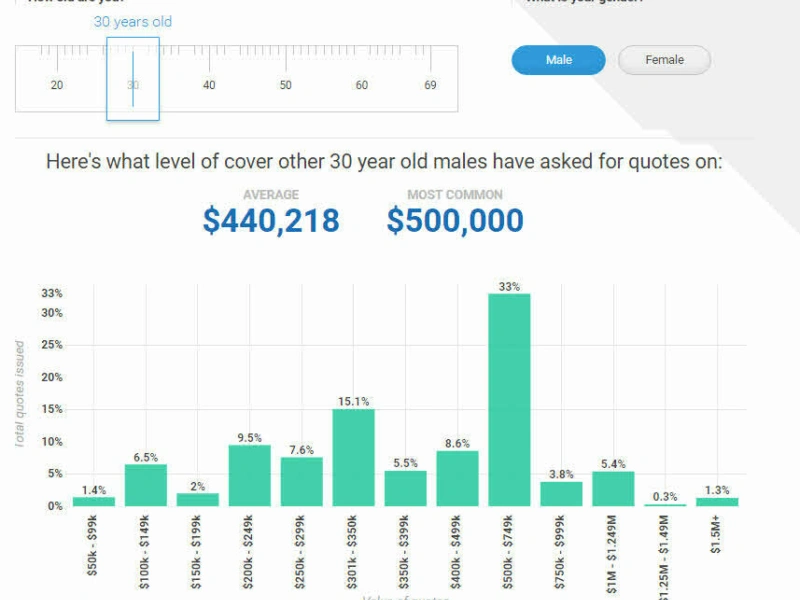

Having a life insurance policy ensures that your loved ones get some financial support after you are gone. Everyone’s needs will be different – and it depends on your life-stage and your future plans. We’ve developed some tools to help you work out what’s right for you – including being able to show you what other people in similar situations have done. Check it out here.

We’ve also provided a life insurance calculator to help you get think about what you might need, along with some other tools and information on our website.

And nearly 75% of kiwis can apply and get covered in less than 10 minutes – so get a quote now.

Family Trust

A family trust protects the things you own (your assets) both now, and in the event of your death.

A Family Trust allows you to plan for, and separate out your lifestyle assets (i.e. your home and life insurance proceeds) and protects your family now, and well into the future. The assets you leave behind in your Family Trust must then be used in the best interests of your surviving partner and children, over their lifetime.

These can be set up simply and cost-effectively online and we’ve partnered with TrustUs - another great NZ Company to enable you to do this.

A Will

This is a document that details who gets what when you die. It also appoints guardians if you have underage children. Because, if you die without a will your assets get divided up according to New Zealand Law – and that may not be what you would want.

You can now write your own Will online and at an affordable price. And you can be confident that it covers all the bases as it’s written by lawyers, and checked by experts.

Perpetual Guardian have developed a service to enable you to do this, called eWills.

Other things to think about

Our website also has a list of other things you might want to think about, including:

Enduring Powers of Attorney Financial Planning Body or Organ donation Plus some links to some independent websites who have more information available to youSo take a look today at pinnaclelife.co.nz, and make sure you have all the protections in place to ensure that your family is well looked after, if the unexpected happens and you’re not here to look after them.