Easy online Life Insurance.

Helping New Zealanders get their Life Cover sorted for over 20 years. Get a quote in 30 secs.

Our Awards

Learn moreWe keep things simple. Our policies are written in plain English.

Life Insurance

Life insurance provides for those you leave behind. It helps them pay the mortgage, invest in education, put food on the table, and pay the bills.

Income Protection

Income Protection pays you a monthly amount if you are unable to work due to illness or injury - so you can carry on with your life even though you're not earning.

Disability Cover

Critical Conditions Cover

We’ve paid 93.6%* of the claims made on our policies

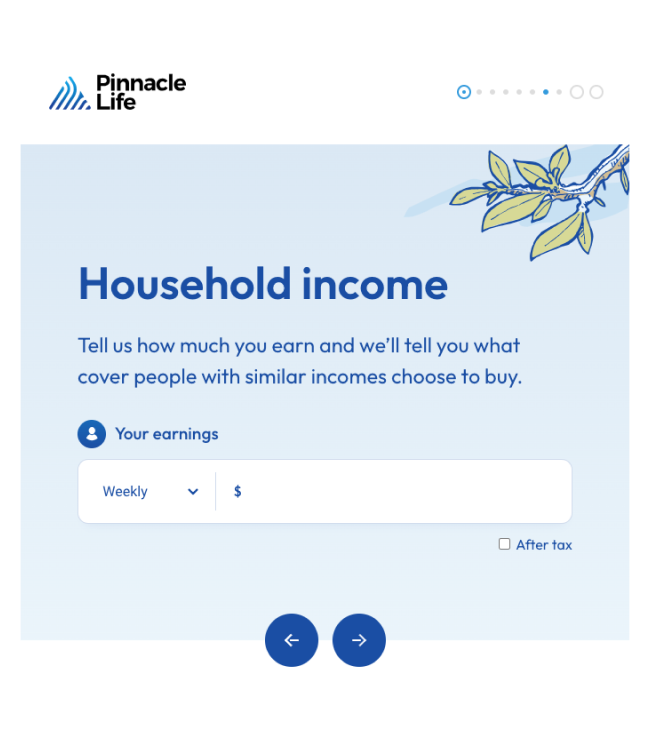

Need help working out what life insurance you need?

What type of cover should you choose? How much will it cost? For many people, this is where buying life insurance gets complicated and overwhelming. We've got the tools to help.

Our customers say the loveliest things

View all reviewsVery helpful and friendly and informative. Quick and easy and straight forward

Extremely good with advice, and helpful with forms. When in contact they always did what they said they would do.

I needed to transfer ownership of my life policy to myself as my wife has passed. I had last year claimed her life policy where the process was straight forward and I received the payout was prompt.

Absolutely awesome web platform to get started on. Honestly the easiest online platform I’ve ever used. Great follow up call from the pinnacle team, really made me feel that they wanted my business and that I’m a valued customer. Exemplary service and professionalism

Was very happy with Pinnacle life. The cost and cover was exactly what I needed at the time. Though I have moved on due to having a different need now I would still recommend Pinnacle life to anyone needing cover that is cost effective.

Existing customer looking for some support? You’ve come to the right place.

From updating your contact details and payment method to managing your policy, we’ve got you covered.

Why Pinnacle Life?

We want Kiwis to be able to protect those that matter most, in a way that is easy and affordable.

-

Online cover made simple

We write everything in plain English so that it's easy to understand with no surprises. Life cover should be simple.

-

Designed for Kiwis

We want every family in Aotearoa to have the choice of getting the protection of life insurance and we want it to be easy.

-

Affordable Insurance

We know life can get expensive, so we tailor our advice to something you can afford.