Why are articles about buying life insurance typically bad news?

Take for example this article by Diana Clement a few weeks ago in the NZ Herald, which highlighted;

- 45% of Kiwi families have no (that’s ‘N’…‘O’) life insurance cover at all.

- Just 0.9% of Kiwi household expenditure in 2010 went on life insurance… down from 1.1% in 1995!

All we (in the life insurance industry) want to know is… why?

Why can’t we get people to whip out their credit cards and fight each other over the best deals on life insurance – just like they do at the Apple store? I mean, what’s the matter with people that prefer to buy wonderful new gadgets and gismos ahead of life insurance to keep their loved ones afloat if they were to die suddenly (did you catch those violins??).

And then a couple of days ago I came upon this article and wondered if it miraculously offers us the elusive reason why people avoid buying life insurance.

The article is entitled “Cost Perception May Deter Life Insurance Sales”; and that pretty well sums up the contents. What was interesting is that this article is not based on ‘opinion’, it’s based on market research carried out by LIMRA.

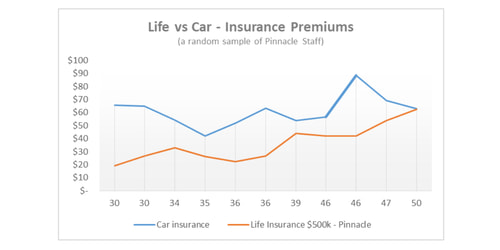

Survey respondents in the US were asked to estimate the annual cost of a $250,000 life policy for a healthy 30-year old. Whilst respondents on average estimated the cost would be around $34/month, the actual cost was in fact closer to $12/month.

So, on average, people who have no insurance assume the cost of life insurance is almost 3 times greater than it actually is.

Imagine if you thought the average Apple computer was around $7000.00.

Would you still be that keen to fight your way into an Apple store to play with the toys?

Hmmm.