The problem with life insurance is that those who need it most, don’t have it, or they can’t get it due to their health. It's distressing to learn how few people with young kids have life insurance. Stay-at-home spouses have a special need for life insurance. Should a stay-at-home parent pass away, the remaining parent would find themselves suddenly paying for childcare and everything else a stay-at-home parent does on a day to day basis. That's why it's essential the parent at home has a policy.

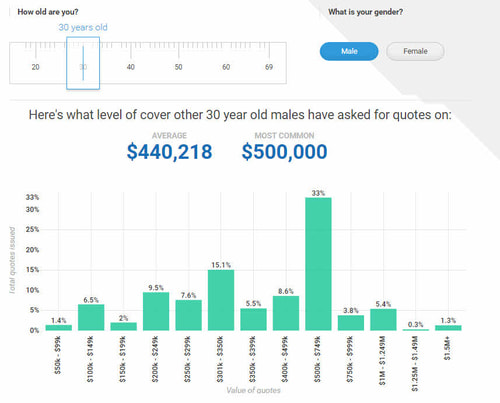

Too often, we're sold insurance products with the broker’s eye on commissions rather than genuine need or affordability. That's a recipe for failure when you have to pay the premium, and it sets too many of us up for a lapse in coverage. Approximately 25% of people who buy life insurance stop paying their premiums in the first three years. By the 10-year mark, almost 50% quit paying. So you pay all that money, month after month, to wind up with zip. What you need is a policy that's easy to buy, easy to own and cheap! Buying what's called "protection insurance" is simple and costs practically no money at all. From Pinnacle Life a 45-year old male can get a $250,000 life insurance policy and only pay about $35 per month. Women's coverage is even cheaper because they generally go to the doctor and take care of themselves a lot better than their male counterparts.

Remember these 5 pointers when shopping for a policy

- Shopping for life insurance is easy on the Internet.

- Certain health conditions make insurance more expensive or even unavailable. If you have such a condition, you're what's known as "loaded" in the industry, which means you will pay more money than the example given for a 45-year-old guy.

- How much life insurance do you need? The simplest rule is … whatever you can afford to maintain long-term.

- Stay-at-home spouses who care for children should have insurance too. They have an "insurable need" because you'd have to pay someone to care for your children in the event a spouse or partner dies.

- Cash back offers and the like are good for the first year, but life insurance is a long term commitment, so get the policy that is going to be the cheapest over a long-run.