So, it's that time of the year again. A new year, new beginnings, new opportunities, and maybe even a new you.

These are common things you hear in January. Why? The beginning of the year is the most popular time of the year for most of us to take a step back and hit the reset button. We make new year's resolutions to set goals and make positive changes in our lives. The start of a new year provides a sense of a fresh start and a new beginning, which can be motivating for people to make changes in their lives. When we set out these changes, we are expressing self-efficacy which means, believing in our ability to achieve our goals gives us a sense of control over what is happening in our lives.

According to studies, around 80% of New Year's resolutions fail by the second week of February. The reasons for this can vary, but some common reasons include

·Setting unrealistic goals

·Lack of a clear plan

·Lack of accountability

·Difficulty sticking to the resolution over time.

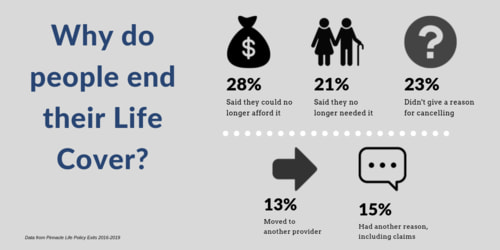

Achieving finance-related New Year's resolutions can be particularly challenging, which means sometimes we can't put enough money aside to take care of some important things in our life like life insurance. Every week we make decisions about how to spend our money. Some costs we have more control over and others less. Some have an immediate benefit, and others are harder to see, which is why a life insurance policy is sometimes lower on the priority list. But with the right strategies and mindset, you can achieve your 2023 financial resolutions and find comfort in securing your family's financial future with the many benefits of a life insurance policy. Here are a few tips to help you plan and achieve your financial goals:

Be Specific - Start by setting specific and measurable goals: Instead of resolving to "save more money," set a specific dollar amount or percentage of your income that you want to save. You should also give yourself a specific time frame in which you'd like to save this amount of money.

Make a budget: Having a clear understanding of your income, expenses, savings and debt is key to achieving your financial goals. Create a budget that prioritizes your expenses and saving goals, but also try and be flexible by keeping track of your spending and making changes to your budget as necessary to keep it in line with your income and goals.

Prioritize high-interest debt: High-interest debt can be a major drain on your finances, so it's important to pay it off as soon as possible. Prioritize paying off high-interest credit card debt and personal loans first.

Set automatic savings: You can set up automatic savings transfers from your checking account to a savings account on a regular schedule, such as weekly or monthly. This can help ensure that you are consistently saving a portion of your income. You can also edit the amount you want transferred as things may change.

Keep track of your progress: It's important to keep track of your progress toward your financial goals. This can help you stay motivated and adjust as needed. Simple solutions include using a notebook or spreadsheet to track your finances and make notes. This can be a good option if you prefer to have more control over your budget and don't want to rely on an app or software.

Take advantage of technology: There are many apps and tools that can help you manage your finances, set budgets, and track your spending. Use them to help you stay on track with your financial goals.

By following these tips, you'll be well on your way to achieving your financial New Year's resolutions. Remember to be patient, as it takes time to see the results, and don't be discouraged if you face setbacks along the way. With the right strategies and mindset, you can achieve your financial goals and improve your financial well-being.