Life Insurance is here to take care of those you leave behind. But, why is life insurance important? What is its purpose? Why should you consider it? And when does it become a crucial part of securing your loved ones’ future?

What is life insurance?

Life Insurance is unique - it’s a tax-free lump sum that pays out in the unfortunate event of the policy owners’ passing or a terminal illness diagnosis. Unlike other insurances that cover things like houses or cars, life insurance covers the risk associated with losing a person. In doing so, it provides financial support to those impacted by the policy owner’s absence, offering a safety net during a challenging time.

Why do people have life insurance?

Life insurance is about providing for those you leave behind, offering support after you’re gone. It ensures peace of mind for your loved ones by covering the mortgage, bills and expenses during challenging times. In the face of terminal illness or unexpected death, a life insurance policy helps your family or loved ones maintain their lifestyle.

When do you need life insurance?

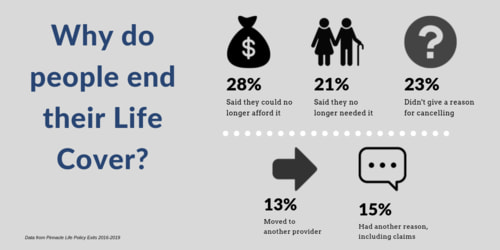

Life Insurance isn’t a lifelong commitment. It’s important when others depend on you financially for debt repayment or as a support pillar but in saying this, life insurance isn’t always a necessity. If you’re single, financially stable, or unburdened by significant debts, it may not be needed. Affordability is also essential, so if it seems like a financial stretch and is causing a struggle to put food on the table or pay rent, that should be your main priority.

As life progresses and you navigate through different stages, finding yourself with a paid-off mortgage, financially secure and with self-sufficient kids, then life insurance may no longer be needed.

---

Life insurance is more than a financial safety net, it’s a commitment to the well-being of those who matter most to you. While it may not be a lifelong commitment, recognising when life insurance is crucial ensures that you can make informed decisions for the benefit of your loved ones.