Simply, income protection provides a benefit if you are unable to work due to illness or injury. Trauma cover provides an early lump sum payout if you suffer from a condition specified in your cover policy.

-

Is Income Protection the same as Trauma Cover?

-

Why do I need to insure my income – won’t ACC look after me?

We often hear people saying that their income is covered by ACC, so they don’t need income protection insurance. Unfortunately, this is not the case if you fall ill, and need to take time off work to recover.

-

How long does it take to receive a life insurance policy pay out?

You want to make sure that if you ever need to claim on your life insurance, that it happens quickly and easily. Here are some tips and ideas to help.You want to make sure that if you ever need to claim on your life insurance, that it happens quickly and easily. Here are some tips and ideas to help make the process easier.

-

How you will “Mind the Gap”?

What's your 'gap' if you couldn't work due to illness or injury? With nearly 1,000 kiwi families a week experiencing a sickness that prevents a main income earner from working for three months or more., it's worth thinking about.

-

Can't work but still have bills to pay?

Can't work but still have bills to pay? Make sure that you and your family are protected if you are unable to work due to illness or injury. Income Protection cover provides you with a regular monthly payment to help replace your income in those tough times.

-

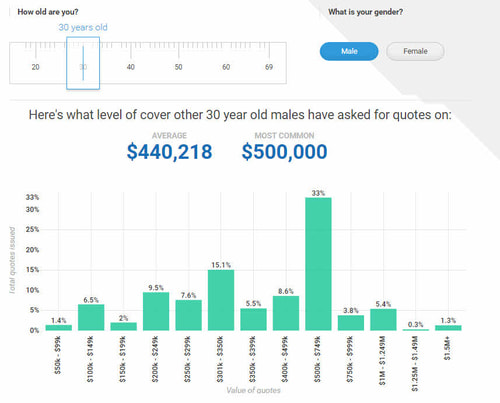

How much life insurance cover do people ask for?

Ever wondered what other people have asked for life insurance quotes on? We've accessed over 40,000 records to give you an insight into this information. Why? Because, we thought people might find it interesting!