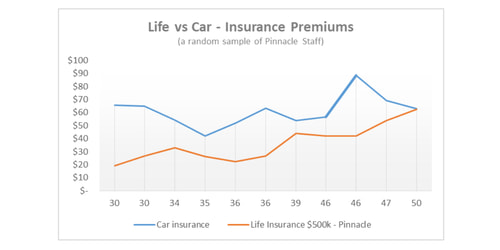

For some, car insurance may well be cheaper than life insurance. But we don’t think it’s as obvious as ‘of course it’s cheaper.’ This is just one of the assumptions about life cover that stop people from finding out more and doing something about getting themselves covered.

-

How much is life insurance? (compared to my car insurance)

-

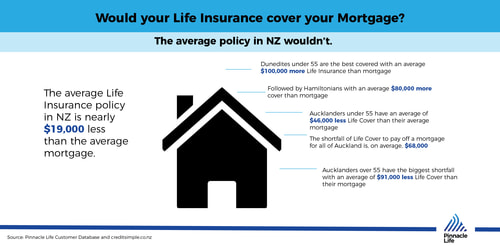

Would your Life Insurance cover your mortgage?

Significant lifetime events such as, getting married, having children, changing jobs or buying a house, are usually a good time to think about Life Insurance. At each of these points you might find you need more cover than you currently have. Then at some point the outcomes of such significant events change and you can start decreasing your cover, for example you pay off the mortgage, your kids leave home etc.

-

How life expectancy is changing - 50 really is the new 40

Most people take out life insurance to ensure their family will be ok financially if they die. Today, compared to 50 years ago, you’re more likely to get sick while you have dependents or a mortgage than you are to die.

-

What do you mean, insurance for adult children?

At some point our children will start to spread their wings, launch into their own lives and, importantly, become financially independent. Thinking about insurance is part of being financially savvy.

-

Do I pay tax on my life insurance pay-out?

The great thing about life insurance payments in New Zealand is that if the owner of the policy is a person, then the payout is tax-free, so what you pay for is what you get. There are some situations though where it gets a little more complex.

-

Life insurance - why buy when you're young?